Evidently, yesterday's OPEC production cut agreement was much more important for the global oil complex. You could probably understand this while viewing crude prices.

However, for those following the routine fundamental data flow, this week's US stats were bullish for crude and bearish for refined products.

Crude stocks drew against expectations, as imports remained relatively low following the previous week's large drop. The draw came despite a drop in refinery runs, which in preceding weeks had been rising seasonally.

Turning to refined products, distillate and gasoline saw larger-than-expected builds, with domestic fuel production continuing to climb in the wake of refinery maintenance season. Total US 4w av. product demand grew by 191 kb/d to 19.83 Mb/d (+1.0% y-o-y).

As we expect crude price consolidation phase likely to extend further, the forecasts for Q1’2016 would be around $55-$60, while the sustenance above $50 seems to be most likely for now.

Trade with safe & limited yields and limited risk:

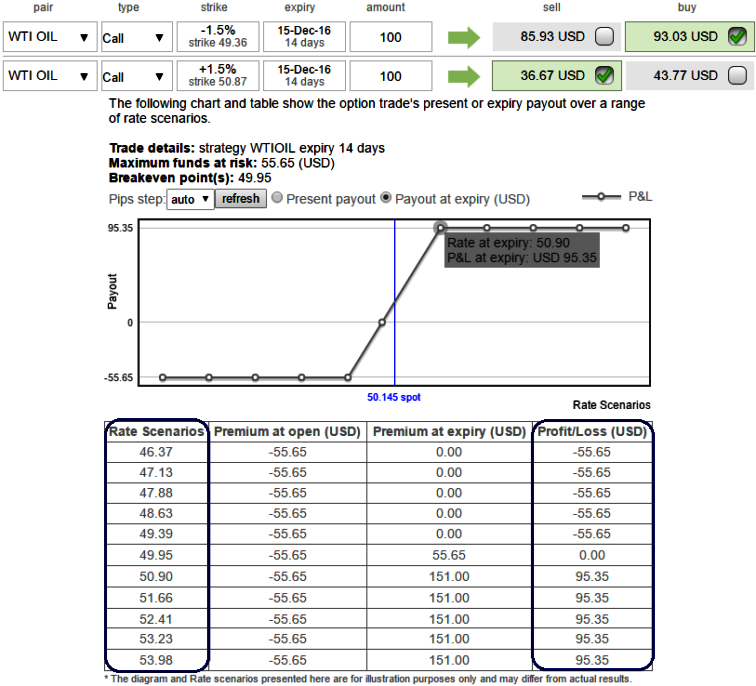

Pondering over the both fundamental developments as well as the technical trend, as shown in the diagram we recommend initiating long in 2w (1%) ITM +0.67 delta call, and simultaneously short 2W (1.5%) OTM call with preferably positive theta or closer zero, the strategy could be executed at net delta of 25%.

Margin: Yes, needed on the short leg.

Rationale: Capitalising on bullish sentiments backed by the reliable fundamental news as stated above but upside potential capped at around 54-55 levels.

The Delta is continuously varying as the underlying spot FX fluctuates. Long options with further in-the-money (ITM) would have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy run-through:

One can use this strategy upon the expectation of speculative grounds that the underlying WTI crude spot would rise but certainly not with drastic pace.

The strategy could derive the positive cashflows as long as spot WTI crude price trades above $50 mark, and even if it goes against, the maximum loss is limited by OTM strike price, having shorts in this strategy capitalize on reducing vols and initial premiums that we receive would finance for the long position.

Risk/Reward Profile: The profit is limited by OTM strike price, No matter how far the market moves above, the profit remains the same.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One