Following the initial flash crash earlier last Friday, the Turkish lira appeared to be stabilized for a while before it continues to depreciate slightly again. The lira is not alone in this: currencies such as the forint have weakened as well in this general risk-off environment.

However, we should note that in the case of the lira at least, initial depreciation often 'catches fire' later because the market wants to 'test CBT's resolve' – this has become a standard market theme since 2013 as CBT has typically been reluctant to raise rates. This tends to kick-start a spiral between TRY depreciation and inflation, which then results in significant FX overshooting.

In this manner, an externally-driven currency move ends up acquiring a 'life of its own'. Depending on how far things go, CBT may or may not be forced to respond with emergency rate hikes.

While the defensive tactic of using high carry to subsidize the cost-of-carry of long vol is more appropriate to apply to currencies like TRY at the other end of the spectrum, where the macro standpoint seems to be bearish.

Funding the current account deficit makes lira vulnerable in periods of low global risk appetite. Strong portfolio inflows of around $20bn helped finance the current account deficit in 2017. The potential for a global environment of lower risk appetite, with the recent equity market volatility and rising DM rates, may dampen international investor appetite.

The EMEA analysts note that real yields in Turkey are still too low to sustainably bring down inflation, the current account deficit continues to widen, and the likelihood of comfortably funding the BoP through a repeat of 2017’s heavy portfolio inflows are slim.

More than outright long vega, bearish TRY views are well expressed through partially delta-hedged risk-reversals, in our stance.

Overall, the lira hasn’t been more volatile but steadily bearish recently, and therefore the tendency for inflation will be to peak and moderate – but only slightly, say to around 9% in the coming months. This extent of moderation will not neutralize Turkey’s long-term inflation, though – at best, it can bring near-term relief. As stated in our previous post the underlying spot FX has hit 4.00 mark In the medium-term term, we, therefore, expect USDTRY to head up towards the 4.0350 mark.

Hence, we add to our bearish TRY position as a hedge to rising core yields with a deteriorating current account balance adding challenges to the lira outlook.

Trading tips:

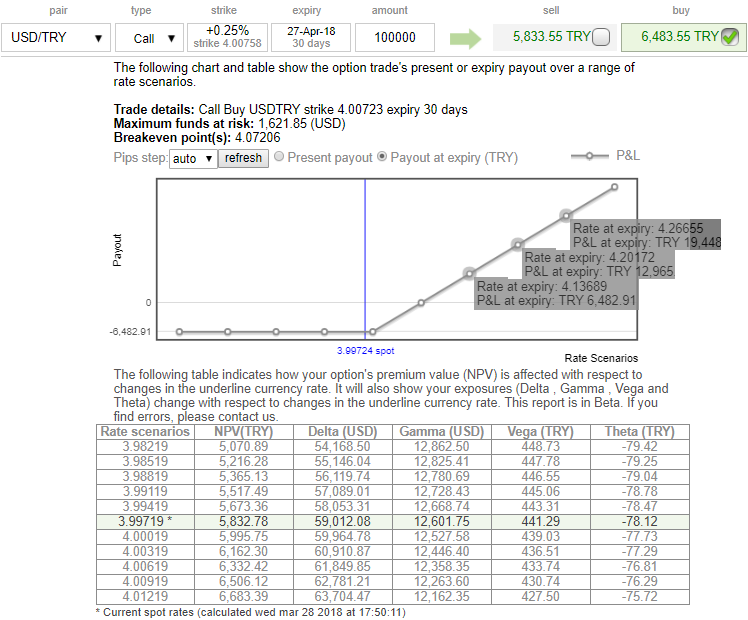

We had advocated buying USDTRY +0.59 delta call (4.00) and EURTRY call (4.83) (equal weighted USD notional), we wish to roll on the same positions using near-month tenors on hedging grounds ahead of lingering potential upside risks (refer payoff structure for exponential effect in yields as the underlying spot FX keeps rising).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts