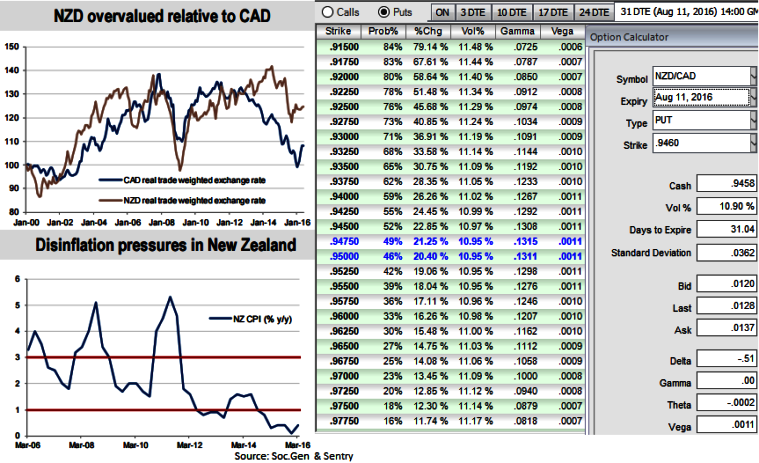

NZD remains overvalued, while milk powder prices have stayed depressed and inflation in New Zealand has surprised to the downside.

New Zealand is suffering from disinflationary pressures, with reported CPI inflation well below the RBNZ’s 1-3% target range (see above graph). It is also more exposed to China growth risks than Canada.

On the data front, NZ’s data calendar next week again holds little importance for markets.

We have REINZ housing update for June, electronic spending (Mon), food prices (Wed), manufacturing PMI, and ANZ consumer confidence (all Thu).

More closely read will be the speech from RBNZ Asst. Gov. McDermott on Wed, on how they decide the OCR, although the bulletin has partly stolen the thunder.

On the flip side, an expected, a plateauing of the oil price trend going forward also eliminates what has been one of the key factors behind CAD strength in the first half of the year. But CAD offers good long-term value, and investors should look to fade any sustained weakness in the coming months.

The Canadian dollar offers better value, and should continue to benefit from more stable crude oil prices and the US economic recovery.

1M ATM IVs are stable just shy below 11% and the sensitivity tool suggests OTM put strikes are on upper hand.

Thus, maintaining shorts in NZD/CAD is a relative value trade with low correlation to global market trends.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close