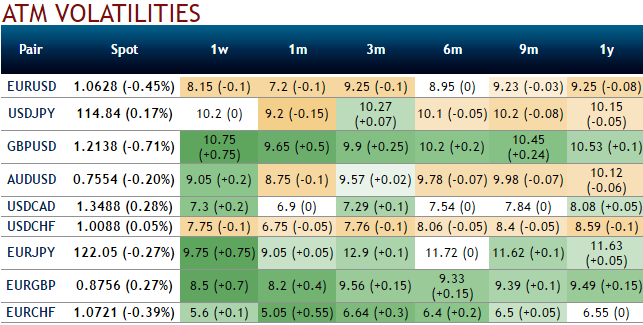

Please be noted that the neutral IVs in USDCAD are creeping up a tad above 7.5%, the tepid implied volatilities of ATM contracts across all tenors are favorable for option writers.

While the risk reversals, for now, have taken adverse directions in 6 months' hedging sentiments that are bidding for downside risks.

Fading towards 7% and below 7.5% for 1-6m tenors, the tepid IVs among G10 FX space despite the fact Eurozone elections are lined up appear to be conducive for call option writers as the delta risk reversals are also bidding for puts progressively with negative numbers that signify hedging arrangements for downside risks over 6m tenors.

USDCAD can be seen below 1.28 driven by:

1) BoC indicates an intention to normalize rates due to an improved global outlook.

2) Global demand pushes oil prices well above $60 and Canadian oil investment picks back up materially.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, if any OTM calls are overpriced, writing such calls are recommended in tepid IVs.

Considering above OTC market reasoning, amid prevailing uptrend we think downside risks can also not to be disregarded in the long term, as result we reckon deploying shorts in such exorbitant call options while initiating longs in ATM puts in our hedging strategies that seem worthwhile under the scenario of the underlying spot FX keeps dipping abruptly driven higher oil prices.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data