The BoE announcement is due at 13:00 CET on Thursday, 19 September, along with the minutes from the meeting. No new signals as long as Brexit is unclarified.

The cyclical macro picture has continued to soften, particularly for the manufacturing and construction sectors. The much larger service sector seems to have stabilized for now.

We believe that manufacturing will likely continue to be hampered by weaker fundamentals in the eurozone and the ongoing trade war between the US and China.

The construction sector could slow further as real estate investments will likely be dragged down by continued Brexit uncertainty. While the worsening outlook may substantiate monetary easing, inflation close to target and a marked rise in wage growth points to higher interest rates. Hence, in our view it is reasonable that the BoE maintains the cautiously tightening bias, indicating a need for somewhat higher rates.

As the outlook is strongly dependent on the Brexit outcome (i.e. soft, hard or no Brexit), in our view it seems wise to abstain from new signals as long as the there is no clarification yet.

There is no inflation report at this meeting. The British central bank to maintain its tightening bias for now. In August last year, the Bank Rate was lifted from 0.50% to 0.75% and the BoE has since guided that future hikes “are likely to be at a gradual pace and to a limited extent”. In addition, the BoE has said that the policy response to the Brexit outcome could “be in either direction”. With a still unclarified Brexit outlook, we find it reasonable that the guidance remains unchanged at this meeting. At this stage, the market is pricing in practically no movement in the Bank Rate until January next year when there is priced in 72% probability of a 25bp cut. Our forecast of a 50bp rate cut in November was based on a no-deal Brexit taking place on 31 October. This now seems unlikely as a majority in the Parliament voted in the favour of a law which prevents such an outcome. In case of a soft Brexit on 31 October or a delay until January, the Bank Rate will likely be kept unchanged until next year.

GBPUSD has been extending its 2-month’s interim uptrend at 1.2435 level, and we could foresee this would hold further momentary upswings. Only a close above the downtrend this would introduce scope towards 1.2592 (which is 7-EMAs). Otherwise, major downtrend still remains intact.

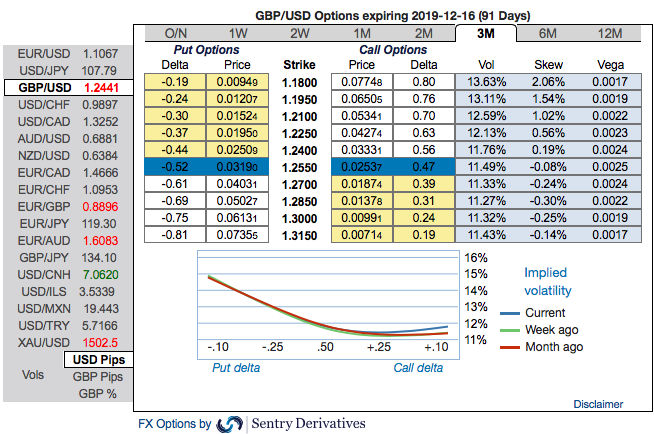

Let’s now quickly glance at OTC outlook and suitable strategy for GBPUSD swings.

OTC outlook: The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks amid the minor positive shift in RRs. To substantiate the downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments. Some positive shift is observed in the bearish risk reversal numbers in the shorter tenors.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Stay short sterling via a limited loss tail hedge: Stay short a 2M/1M GBPUSD bear put spread (1.2592/1.1958). Courtesy: Sentrix, Saxo & DNB

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch