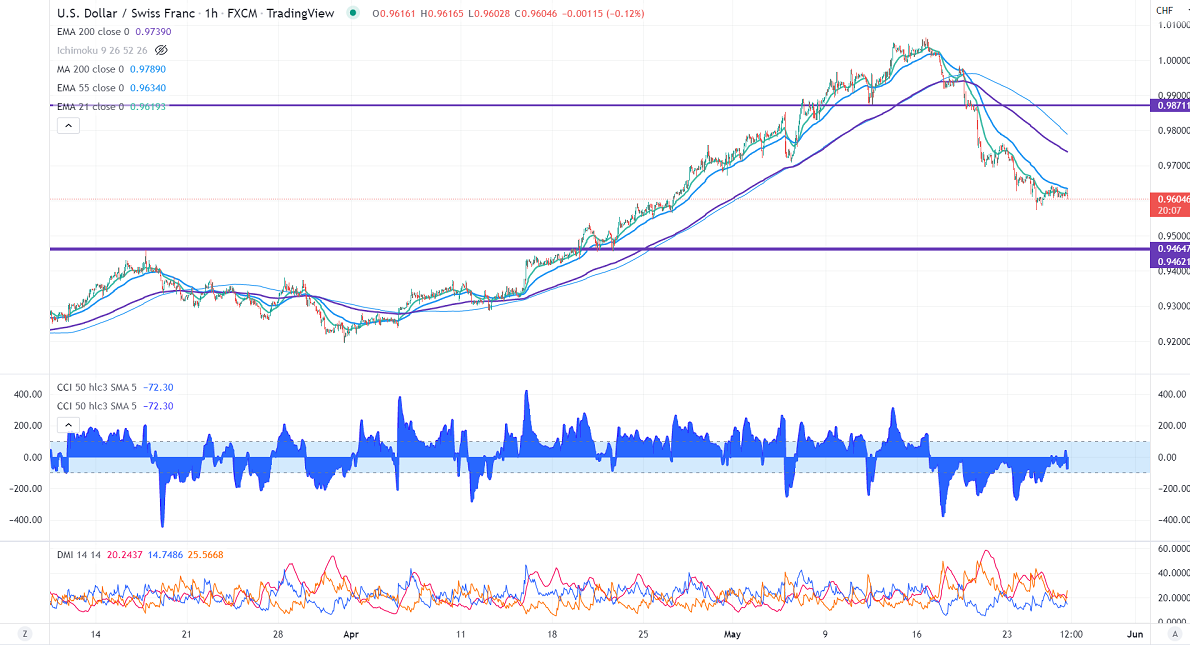

Intraday resistance- 0.9650

Intraday support- 0.9600

USDCHF showed a minor pullback yesterday after hawkish US fed policy. The pair pared its gains as demand for safe-haven assets like the Swiss franc increased. Markets eye US PCE and Prelim US GDP for further direction.US durable goods orders dropped to 0.30% compared to an estimate of 0.50% in Apr. It hits an intraday low of 0.96080 and is currently trading around 0.96117.

Levels to watch

The pair trades below 55,21 and 200- hourly MA. This confirms further bearishness.

Any breach above 0.9650 targets 0.9700/ 0.9740 (200-H EMA)/0.9780 (200-4H MA).

The near-term support stands at 0.9570, a decline below that level will drag the pair to 0.95000.9460.

It is good to sell on rallies around 0.9650 with SL around 0.9700 for TP of 0.9500.