Intraday trend- Bearish

Significant support- 1.3300

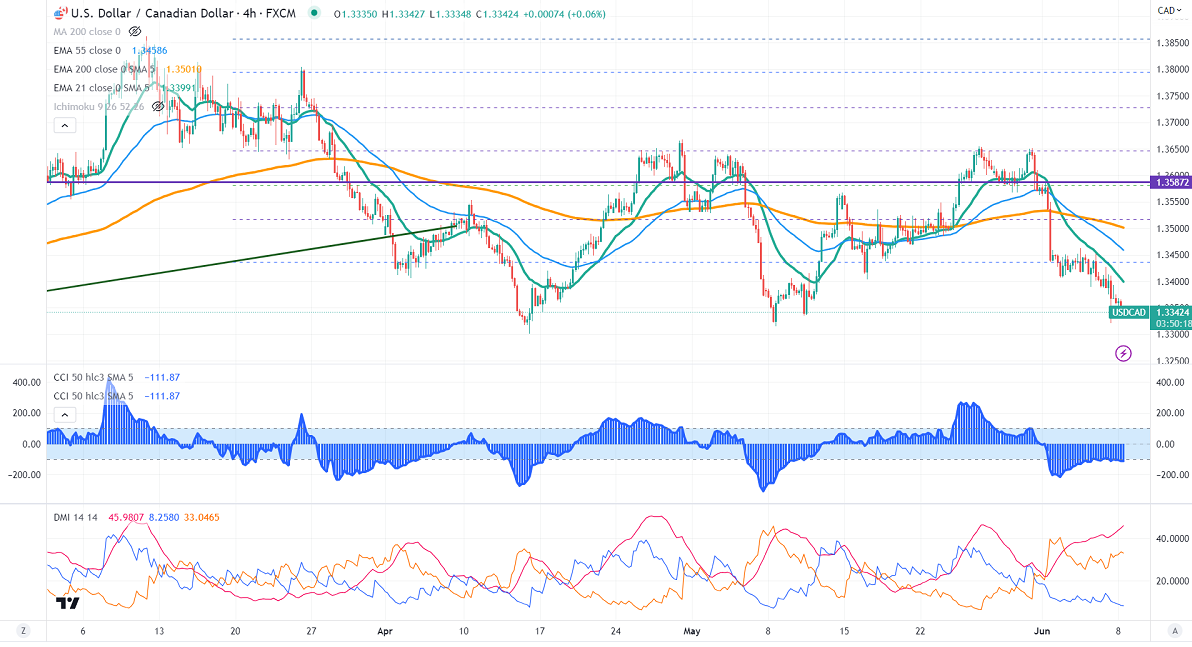

USDCAD declined sharply after BOC monetary policy. The central bank hiked rates unexpectedly by 25 bpbs to 4.75% yesterday, the highest level since 2001. It said in a statement that inflation is elevated due to excess demand in the economy than anticipated. The policy divergence between US Fed and BOC supports the Canadian dollar at a lower level. It hits a low of 1.33208 yesterday and is currently trading around 1.33346.

Technically in the 4-hour chart, the pair is holding below short-term (21- and 55 EMA) and 200 EMA (1.36301). Any break below 1.3300 will take the pair to 1.3220/1.3200.

The near-term resistance is around 1.337 and any breach above targets is 1.3400/1.3435/1.3500.

Indicators (4 Hour chart)

CCI (50)- Bearish

ADX- bearish

It is good to sell on rallies around 1.3400 with SL around 1.3460 for a TP of 1.3220.