EURSEK is unchanged over the past month, albeit once again the cross briefly flirted with the upper end of the six-year range at 9.60-9.70.

We expect continued range-trading through until year-end and then only very modest appreciation from SEK through next year (9.35 by end-16 and 9.15 by Q3’17).

The catalyst for a major break higher in SEK is lacking – a definitive end to the Riksbank easing cycle and a tangible prospect of rate hikes within a 6-9 month time frame.

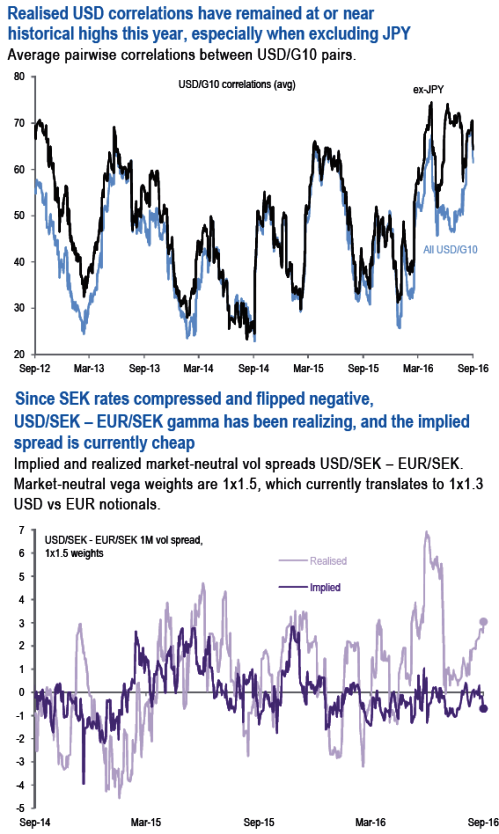

In the case of SEK, long positions in USD vols can be advantageously coupled with short vols in the EUR cross.

Long gone are the days when the market was testing the Riksbank’s nerves in the low 9.0s in EURSEK. The latest Swedish data do point to a rebound from slowing economic momentum.

However, this did very little to improve sentiment and lift SEK, as the undershoot in the country’s Economic Activity Surprise Index (EASI) is second only to NZD among the pairs we track .

With the market looking for negative rates to extend to Q3 2019 – a good 1y past the Riksbank’s forward guidance, it is unlikely that SEK attracts significant inflows, and “we expect continued (EURSEK) range-trading through until year-end”. This range-bound outlook on EURSEK – which the price action around German.

Financials woe doesn’t question, should play its part in keeping USD correlations at historically firm levels, especially when removing the BoJ-led effect of JPY. It is, therefore, supportive of a USDSEK vs EURSEK vol spread trade.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal