The latest soft US inflation print reinforces the view that the dollar is in a broader consolidation, rather than at the beginning of a broader sustained rebound. A less directional dollar on Fed pricing that more in a holding pattern implies more opportunity for currencies with normalizing central banks to more definitively outperform (EUR, CAD), it should allow more idiosyncratic developments elsewhere to drive relative performance, and it also reinforces our EM team’s overweight EM FX view. Select EMs with idiosyncratic issues aside, FX vols are reprising their typical seasonal weakness in October.

3m USDTWD call strike 30.70 knock-out 29.85, the maximum loss is limited to the extent of initial premium paid.

Rationale:

Re-rating of growth expectations: Growth-sensitive North Asian currencies should be hit the hardest in the event of a US or China slowdown. The suspicion on Taiwanese central bank’s intervention is not only limiting gains but makes the Singapore dollar is more interesting than Taiwan’s.

Technicals: We’ve already stated in our exclusive technical section, intraday bias remains neutral till the time pair holds key resistance at 30.22 mark. USDTWD is currently trading around 30.19 marks. It made intraday high at 30.20 and low at 30.10 marks.

USDTWD has failed to close below 30 (intra-day low of 29.92) and CBC intervention should limit the downside given US trade policy is more benign.

The governor of the Central Bank of the Republic of China (Taiwan) has handed out a caveat to central banks about volatility risks and short-term losses that can be associated with a shift away from traditional reserve investments, such as US government or mortgage agency bonds.

Perng Fai-nan at the central bank indicated that it is equipped with almost $450 billion of reserve assets, has had to confront a series of speculative and leveraged spells against the new TWD during his term as governor, which started at the height of the Asian financial crisis and spans nearly two decades. As a result, he is keenly aware of the value of being able to demonstrate he can draw on reserves when fending off currency and other speculators.

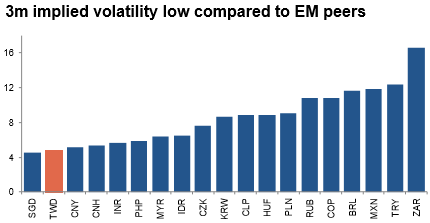

Vol parameters: Implied vol is among the lowest in EM FX and close to the bottom of the 2yr range, while skew is also very low, making dollar calls relatively inexpensive. The sensitivity of vol to spot moves is higher than other most Asia pairs, benefiting the structure if USDTWD moves up prior to expiration.

Key levels & strategy:

Add exposure: Limited chance USDTWD breaks meaningfully lower amid softness in Chinese data unless there is a massive risk-on in emerging markets. Barrier level is below the cyclical intraday lows.

Risks & what to watch for:

Equities and trend line support: Rising equities or a break of the cyclical low (29.92) could see a test of long-term trend line support (29.70). Courtesy: SG, Bloomberg

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise