USDJPY does not seem that vulnerable into and through the September 21 Bank of Japan (BoJ) policy decision. We highlight the potential for disappointment and a possible market reaction similar to that observed in July and April, with the risk of the extended move that followed the January misfire.

The downside risk is not amplified but remains intact by the escalation in expectations relating to the policy outlook. USD/JPY gained 0.35% to a one-month high of 103.86.

On the data front, today’s attention will be squarely on the US September labour market report. Nonfarm payrolls in the prior month posted a weaker-than-expected rise of 151k.

Weekly jobless claims over the past month, however, provide no indication that the labour market is faltering and so we expect a sizeable monthly payrolls gain of 195k in September, above the market consensus for 172k.

The unofficial ADP figures showing a rise of 154k in private payrolls may, however, point to downside risks. We also forecast a fall in the unemployment rate to 4.8% from 4.9%.

OTC updates:

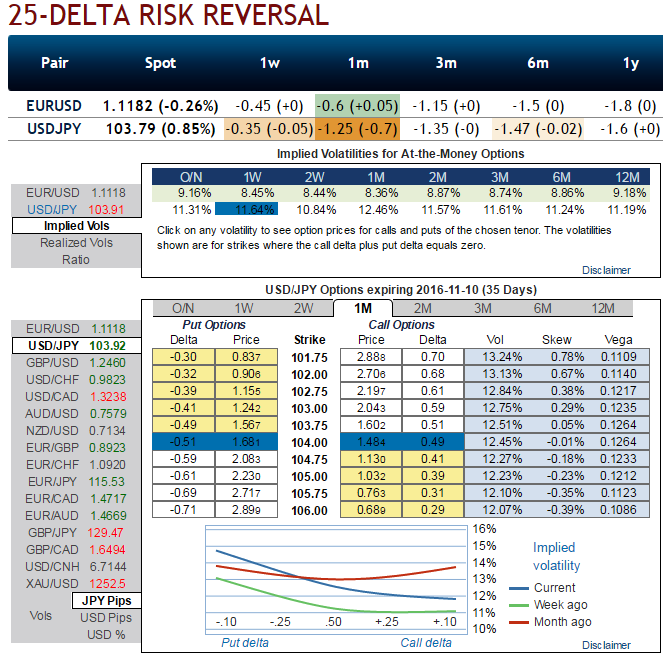

As per the nutshell showing implied volatilities and delta risk reversals, USDJPY is the pair to have highest 1m IVs with hedging sentiments for downside risks in this tenor as a result of above fundamental drivers. Whereas the long-term hedging arrangements for downside risks still appear to be intact. Hence, we recommend below option strategy so as to match the above fundamental as well as the OTC scenarios.

While USDJPY pin risk is seen in options expiring on this Friday at strikes 101.25, FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices. That is, the spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Option Trade Recommendation:

USDJPY is trading at 103.889 (i.e almost more than 1-month highs), the highest since August series. So while the market is happy to buy USDJPY as a positively convex play on the next BoJ meeting, the result of such demand is that USDJPY is now 2% expensive compared to the 10Y rate spread. Hold a USDJPY put fly (104.777x103.844x103.223 in 1x2x1 notional) with 2w expiry.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures