It seems that consumers in U.S. are extremely freighted as the decline in the Conference Board measure of confidence to 92.2 in February from previous 97.8 implies that the financial market havoc prior in the month is beginning to weigh more heavily on consumer confidence.

The undershoot in in the headline index reflects a decline in both the present conditions and expectations index, which is somewhat curious given the sharp decline in gasoline prices this month. The more forward-looking expectations index fell to 78.9, from 85.3 and at that level is consistent with real consumption growth of around 2% annualized.

The net proportion of respondents saying jobs are plentiful (rather than hard to get) fell to -2.1, from -0.6 and is now at a level that is consistent with an unemployment rate of a little over 5.2%.

Meanwhile, the proportion of households expecting a rise in their incomes fell to 17.2, from 18.6 while the proportion expecting their incomes to decline fell to 12.5, from 10.7. The net proportion between the two fell to a level that is consistent with growth in average hourly earnings of nearer 2.5%.

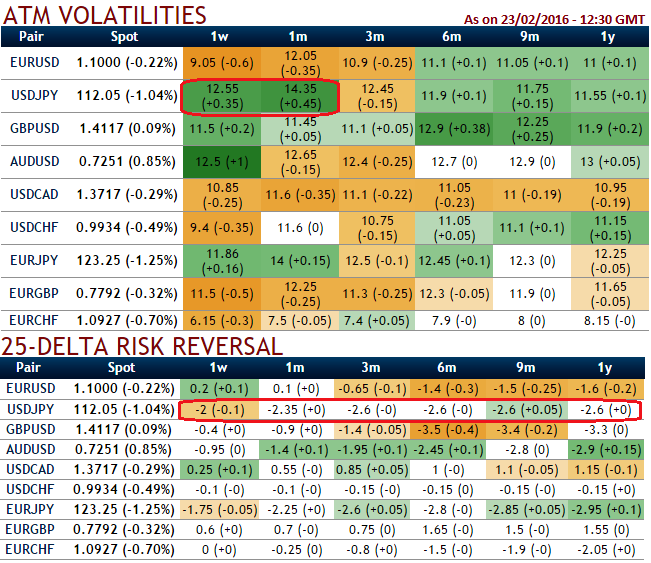

In addition to that, let's glance over the OTC market flashes. Both implied volatility and delta risk reversals for USD/JPY 1M expiry have increased and keep mounting momentum for bearish sentiments in a longer term as USDJPY spot FX has been continuing its downward journey. The yen gained today as well in early Asia as investors look for safe-haven assets in a downbeat global economy. USD/JPY dropped from yesterday's close to 111.800, down about 0.21%.

While this spike in negative hedging sentiments along with rising IVs that is highest among G10 currency segment. If a trader has the right model, he can build the whole volatility smile for any time to expiry by using the three points in the volatility surface.

If IV increases and you are holding an option, this is good. So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: USD/JPY 1M IVs highest among G7, spot FX dipping deep as US consumer confidence shrinks away to market havoc

Wednesday, February 24, 2016 6:25 AM UTC

Editor's Picks

- Market Data

Most Popular

9