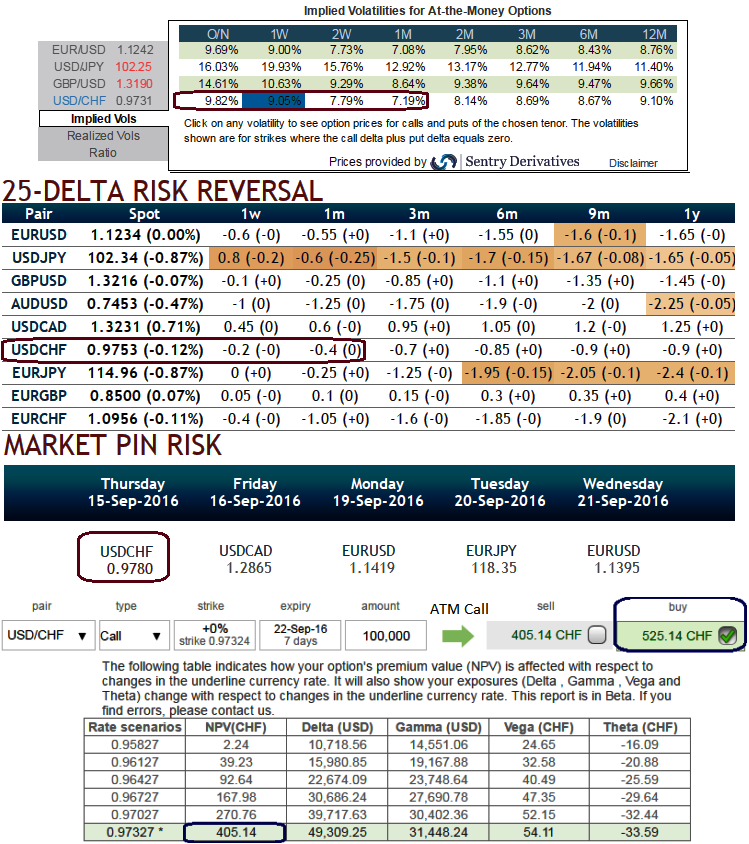

Let’s have a glance through IVs, risk reversals, and market pin risk before we begin with the selection of right option instrument.

The current ATM implied volatilities have slipped below 10% after SNB maintained status quo in its monetary policy, (unchanged rates at -0.75%), 1w tenors have also reduced to 9.05%. Whereas 1w ATM calls are priced at 29.6%.

While, risk reversals of 1w and 1m tenors have also been unchanged, so bearish hedging sentiments is still visible in this pair’s OTC, on the other hand, spot FX has been moving in sync with the market pinned risks at the strikes of 0.9780 and tepid IVs. These strikes indicate sizeable open interest close to the current forex spot rate.

We see no significant changes in 1m – 3m bearish hedging sentiments in OTC FX market of this pair. Accordingly, we reckon it would be wise to capitalize on these indications to hedge downside risks

Positions of significant size in the forex options market can have an influence on the underlying forex spot rate.

FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices. That is, the spot may trend around those strikes as the holders of the options would aggressively hedge the underlying delta.

Thus, we think that it is the right time for writing the overpriced out of the money calls with narrowed expiries.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays