The fact that market attention will focus less on the US labour market report today may mean that the Canadian labour market report receives more attention.

We doubt whether this will turn out to be quite so positive for CAD.

The currency is suffering as a result of the falling oil price anyway and following rising employment in August and September there is likely to be a notable countermove in October which would be expected to put pressure on CAD.

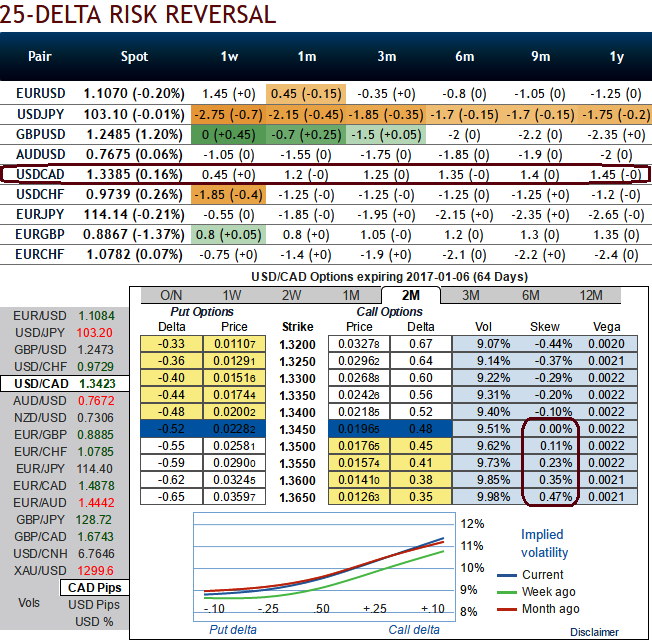

OTC outlook:

We reckon the above fundamentals seem to be reasonably addressed by hedging participants, as you can observe the risk reversal flashes for 1 and 3 months tenors, although we see neutral changes to the bullish risk sentiments, as a result, USD seems to be gaining in next 2 months tenor on recent OPEC’s announcements, on account of series of significant data events such as the US presidential polls and on the eve of Christmas where Fed’s chances of hiking can’t be disregarded.

Mounting positive skews in 2m implied volatilities suggests RKO calls on speculative grounds, the USDCAD 2-3m skew has been bid with Trump progresses in the polls, lifting it to its highest level since June 2015.

Speculative call:

Given the vol surface set-up, we see two possible option constructs to play the resulting grind higher in USDCAD but taking minor bear swings in consideration:

i) USD call/CAD put vol flies are severely depressed, much more so than ATMs (see above chart); 1*2*1 USD call/CAD put flies are therefore natural expressions of slow and steady CAD weakness.

For instance, a 3M 1.33 /1.36 with 1.39 RKI/1.39 USD call/CAD put 1*2*1 butterfly (at spot ref: 1.3342), and delivers 4 times maximum payout ratio if the RKI triggers, 9.5 times if it does not.

ii) As an alternative, one could also short shorter-dated strangles to finance the purchase of longer-dated USD call spreads and exploit the inversion of the term structure.

For instance, one could mull over shorting 1M 1.29/1.35 strangles to finance the purchase of 3M 1.33/1.36 call spreads, a nearly 75% cost savings to buying the standalone call spread.

Hedging Framework:

Strategy: 2m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for 2m IV skews would signify the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

The execution:

Go long in USDCAD 1M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money put.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios