The Bank of Canada has been signaling an imminent rate hike, if not in the July meeting then in September, and this is now priced in. The BoC is giving greater prominence to financial stability concerns stemming from high Canadian household indebtedness and regional housing booms. Although our early 2018 target for USDCAD has been reached, the loonie’s undervaluation should support further appreciation in the months ahead.

Only a handful of the analysts polled by Bloomberg expect a further Bank of Canada (BoC) rate hike today. All others, us included, believe that it will leave its key rate unchanged at 0.75%. The market reaction to the rate decision is going to be more pronounced than analysts’ forecasts suggest, as the market is pricing in a rate hike with a much higher probability (above 40%). So if the BoC was to leave everything unchanged today, CAD is likely to ease notably and is trading almost 6% above the level assumed by the BoC. Excessively aggressive rate hikes would risk an overshooting of the exchange rate.

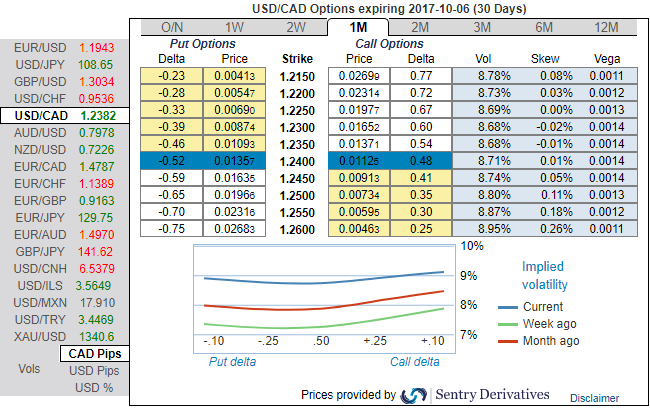

In the recent times, CAD vols skews destabilized too much especially on crude’s price sustainability, while USD volatility market normalized sharply (you could observe that in USDCAD IV skews) which has been well balanced on both the sides. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the options market aggressively unwound smile positions.

While the implied volatility remains among the three lowest G10 vols, seeming options globally inexpensive. Despite the recent CAD appreciation, the USDCAD realized volatility has remained muted due to the low realized vol environment which makes knock-out barriers attractive.

Two-month USDCAD absolute moves observed on a daily basis since 2013 has been 88% smaller than the current distance between the spot and the KO barrier (690 pips). This makes the KO event unlikely. Risks are limited to the extent of premium. If USDCAD spot hits the 1.23 barrier at any time before the 2m expiry, the option will expire instantly. Hence, USDCAD 2m put strike 1.27, knock-out 1.23 (at spot ref: 1.2380).

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action