Mexico-induced reprisal of risk in Brazil best expressed via long USD/BRL skews / vols hedges: Is Brazil bound to go down the same slippery path of some of the other recent populist governments? It’s yet to be seen. BRL skews have rolled off the election premium, narrowed down back to a long-term average and to only a touch above the year start level.

While from the systematic trading standpoint BRL is only marginally different from the above MXN analysis, the risk from a reprisal of this week’s AMLO surprise in Brazil keeps us defensive and biased to long vol and long skews.

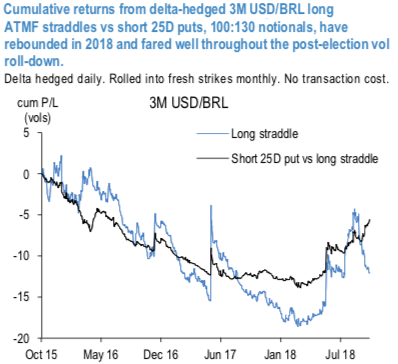

While delta-hedged 1*1.5 ratio put spreads performance wasn’t exactly stellar (when compared to the outstanding 1*1.5 ratio call spreads), selling OTM puts is a good way to subsidize long vol lean. Namely, a long straddle vs short 25 delta OTM USDBRL put in 130:100 notionals structure (refer above chart) would offer a natural protection in case of further shift lower in BRL vol surface. Also, in the event of upbeat, risk-on, sentiment (i.e. post-election honeymoon period), which could gradually drive spot lower, soft realized vol with spot at the short leg should benefit the trade.

Returns from a 3M USDBRL long ATMF straddle vs short 25D put (delta-hedged) have rebounded in 2018, fared well throughout the post-election vol roll-down and exhibited significantly less volatility of returns relative to outright long delta-hedged straddles (refer above chart). In support of the long skew (via short OTM puts) lean, at 56% for realized vs. 45% for SABR implied, spot-vol correlation is performing. Though, complicating matters, impact from election will (somehow artificially) remain embedded in realized spot-vol for nearly full 2 more months (in case of 2m trailing).

We recommend delta-hedged 3M USDBRL long ATMF straddles @14.35/14.6 indic vs short 25D puts @13.5 choice, in 100:130 notionals. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD is inching at 22 (which is mildly bullish) while articulating (at 12:24 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data