The next upside target is 0.7130 (50% retracement of Feb/Mar decline).

NZDUSD’s medium term perspective: Potential for higher to the 0.7150-0.7300 area during the month ahead, as USD longs are pared. Further out, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD down towards 0.6900 or lower. Weaker dairy prices plus the RBNZ’s emphatic reminders it is on hold for a long time should also weigh.

OTC Updates and Hedging Strategy:

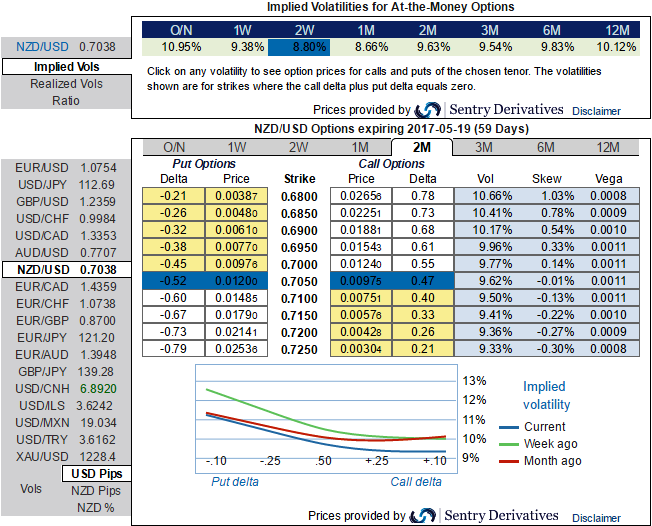

Please be noted that the implied volatility of at the money contracts of this APAC pair has been dropped below 9% for 2w expiry and shy above 9.6% for 2m tenors, while 2m vega contracts are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers.

As the positively skewed IVs of 2m tenors and vega’s interest on OTM put strikes could be interpreted as the option holder’s opportunity in the medium run.

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1.5%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 2m ATM +0.49 delta put options and 1 lot of (1%) ITM -0.61 delta put of 2m expiry.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure