The sterling has been able to gain conspicuously in the recent times and continued the same momentum especially yesterday following the publication of the August inflation data. GBPUSD surged above the 1.3300 mark, while EURGBP momentarily eased below the 0.9000. UK CPI managed to produce upbeat numbers, actual at 2.9% versus consensus at 2.8% and previous flash at 2.6%.

The higher inflation is usually bad for a currency. The rapid erosion of domestic purchasing power is a negative signal for the purchasing power of the currency on the FX market.

However, the reverse applies if the central bank responsible for the currency provides a rate advantage with disproportionally high rate hikes that actually overcompensate for the inflation effect. It would seem that the market assumes that this constellation applies in case of the higher UK inflation. That may come as a surprise as the BoE has been rather hesitant as far as rate hikes are concerned over the past few months. Everything all told the impression dominates that the BoE does not react very actively when it comes to higher inflation but accepts it as an unavoidable side effect of the Brexit related GBP weakness.

However, this prejudice has been priced into the GBP exchange rates since the August BoE meeting. A visible positive inflation surprise - in particular only two days prior to the next MPC meeting - can change this prejudice at least marginally.

However, the following also applies: if the MPC was to maintain its sanguineous approach tomorrow the disappointment of all those who entered into GBP longs yesterday would be even bigger (and thus the negative effect on the British currency even more pronounced).

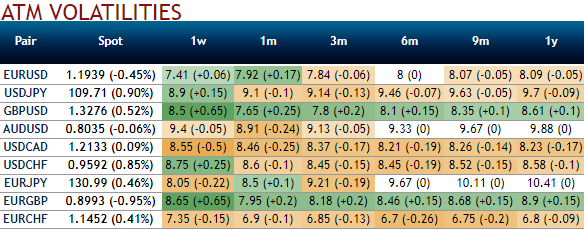

Please be noted that the hedging activities of GBP have been mounting higher, IVs have been progressively rising higher but still on the lower side. The sell-off in the cable skew is exaggerated compared to ATM volatility since the risk remains asymmetric on the downside, the tail risk is mispriced.

While risk reversals have slightly shifted into positive flashes but bearish risks have prevailed on a broader perspective. Hedging sentiments of this pair have turned towards upside risks.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook