The Turkish lira has entered another perfect storm, as shaky macro fundamentals are eroded by the bullish crude oil price, weak emerging market sentiment and the returning personal grip of President Recep Erdogan on the economic processes, TRY and monetary policy.

The markets continue to dislike this kind of interference, now pricing extremely high TRY hedging. We expect the TRY sell-off to calm down if the President announces a fiscal austerity programme and signals more central bank independence.

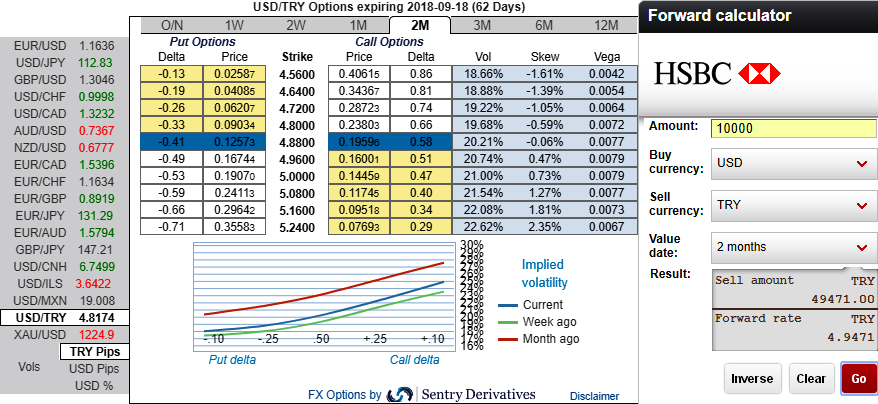

In the near term, even though USDTRY likely to slide down a bit from the current levels, updating the forecast as follows: 4.80 in 1M, 4.90 in 2M, 5.20 in 4M and 5.10 in 6M.

While we hold off moving UW with the CBRT surprising once again. The aggressive 500bps of tightening cumulatively delivered since April 25th is supportive for the currency in the first instance, however, we see a portion of it as merely “catching up”, with inflation accelerating.

Please be noted that the positively skewed IVs and forward rates of 2m tenor indicate mounting bullish risks which are in line with above projections (refer above nutshell for IV skews and forward rates).

At spot reference: 4.8167 levels, contemplating above driving factors, on hedging grounds we initiate 2m USDTRY ATM +0.51 delta call options.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 55 (which is bullish) while articulating at 14:05 GMT.

For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts