The BoC should have an interest in the CAD not appreciating significantly against the USD. After all, it does not want to burden the economic and inflation outlook too much with a strong CAD as the competitiveness of Canadian companies already suffers from the significant increase in the minimum wage in the Ontario region at the beginning of the year (further regions are to follow in the course of the year) and the agreed corporate tax reduction in the USA. A stronger CAD would further reduce competitiveness.

Hence, the BoC should not raise its key interest rate significantly more aggressive than the Fed for the time being in order to avoid a continued strong CAD appreciation against the USD.

The risk for that has declined which increases the likelihood of the Bank of Canada's continuing its rate hiking cycle, which supports CAD.

Nevertheless, we expect USDCAD levels to trend higher over the course of the year, mainly because the market has already almost completely priced in the interest rate hikes we expect from the BoC, but not yet those from the Fed, which supports the USD.

We, therefore, regard the potential for CAD appreciation as limited for the time being in long run (refer technical chart of monthly plotting, the major trend that was bullish now turned into non-directional), especially as a certain CAD risk premium remains justified until the NAFTA negotiations have actually been successfully concluded.

Options Strategy Formulation:

Contemplating all these factors, one can deploy diagonal ratio call spreads (DRCS). As the underlying pair reveals the downside risks that are intensified anticipating from 1 week to next 1 month in it is going in favor of loonie.

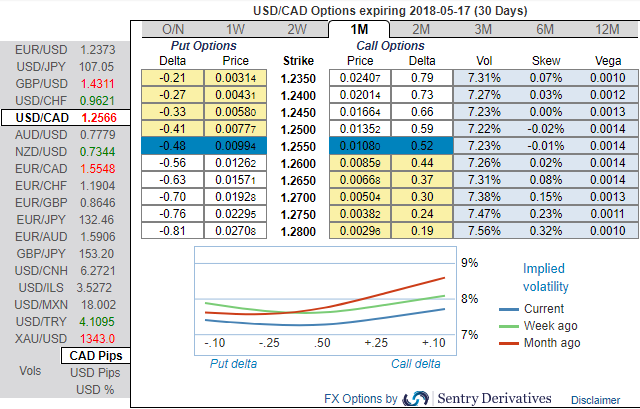

Most importantly, please be noted that the ATM IVs of this pair of 1w expiry is shrinking considerably, which is conducive to writing options.

As a result, we come up with suitable hedging framework for slight downside risks. Place call ratio spread with 1:2 ratios. Current USDCAD FX spot is ticking at 1.2570 levels.

How to execute: Buy ITM (1.2229) 0.8 delta call with longer expiry (let’s say 1m tenor). Sell two lots of OTM strike calls (1.2783). Thereby, we’ve formulated the strategy so as to sync with the IVs, skews and the bullish neutral delta risk reversal.

The delta value becomes more and more insensitive as the USDCAD falls lower and lower and hence on the lower side, the delta value is zero.

On the higher side, it increases in magnitude but remains negative indicating the negative effect on the options trader position with the pair rallying.

Why call ratio spread: As the pair has made steep slumps and healthy recovery we see a neutral to the bearish environment when you are projecting decreasing volatility (see from next 1w to 1 month it’s been gradually reducing, and noticeably shrinking IVs).

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above -5 levels (which is bearish). While hourly CAD spot index was inching towards 12 (neutral) while articulating (at 10:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays