Bullish EURCHF scenarios:

1) Fed definitively ends the hiking cycle but with European growth back at 1.5-2.0% (so more 2006 than 2000;

2) The definitive resolution to US-China trade conflict;

3) continued strong CB demand for EUR,

4) More mainstream center-right Italian govt following early elections (May?),

5) Withdrawal Agreement is delivered, securing an orderly Brexit by June

Bullish EURCHF scenarios:

1) The recovery in the Euro area economy is shallow and short-lived,

2) The ECB adopts a tiered deposit rate,

3) Trump threatens Euro car imports with tariffs following the 232 reports into the industry, 4) UK general election deliver a populist, Brexiteer PM,

5) The escalation of the US-China trade conflict.

The projections for CHF have been modestly constructive for the trade-weighted franc in any case albeit we expected more of this strength to materialize versus a still-cyclically compromised EUR in 1H, before beginning to rotate towards USD in 2H in line with a shallow bounce in EURUSD.

The targets were set at 1.12 EURCHF by mid-year and 0.98 USDCHF on a 1Y window.

The forecasts are left unchanged given the lack of visibility on US-China trade talks but the risk bias is now bullish on CHF.

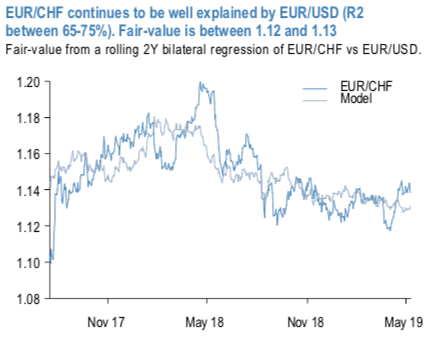

In the absence of an escalation of the trade conflict, EURCHF will likely remain extremely well behaved with respect to EURUSD. Movements in the euro generally explain between 65-75% of the behavior of EURCHF. The fair-value for EURCHF based on EURUSD is between 1.12-1.13 (the former using an 8Y regression window, the latter based on a 2Y period – refer 1stchart). The medium-term fundamental factors which support CHF are still intact in our opinion.

OTC updates and trade recommendations: (Stay short in EURCHF via ITM put options, spot reference: 1.1220 levels).

EURCHF bearish neutral risk reversal numbers and positively skewed of implied volatilities of 3m tenors signify the bearish risks to prevail further (refer 2nd and 3rd exhibits). 25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves. Courtesy: Sentrix, Saxo & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 11 levels (which is mildly bullish), while hourly CHF spot index was at 80 (bullish) while articulating (at 13:56 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data