The prolonged antipodean bearish stance allure strategies through FX options on various fundamental driving forces.

The weakness in the kiwi dollar is predominantly owing to the amplified measures of inflation by the RBNZ was modest and shouldn’t warrant substantial changes from the central bank in the context of softer growth.

While for Australia, firmer employment data is being offset by higher supply as well, so will not impact wage growth by much leaving the immediate impact on the RBA muted at least for now.

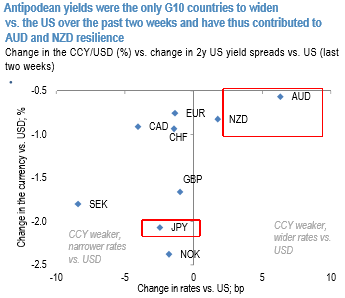

Moves in JPY over the past two weeks have also been unusual in that they are in excess of the moves in interest rate differentials (refer above chart) and came despite developments in China and escalating trade risks.

A few explanations have been discussed in relation to the underperformance of yen—it could be related to the resilience in equity markets thus far, or could be related to capital outflows: our Japan strategists note that this is likely a combination of larger FDI and portfolio investments outflows (for context, that M&A outflows have been higher in 2018 but this was concentrated in April due to a larger, single deal; the first half of July has seen a modest pickup after some cooling in May and June;).

The US dollar should be boosted further ahead of the Fed hikes further this year, and that will push NZDUSD lower. In addition, the NZ-US interest rate advantage has been eroded, removing one of the previous attractions of the NZD. Further, domestic data is indicating the NZ economy is slowing. We expect NZDUSD to slide to 0.67 or lower by Sep.

However, we continue to find value in being long JPY. Not only does this serve as a tail risk hedge, but our Japan strategists note that over the medium term, the synchronized rise in USDJPY and Nikkei index provides the BoJ with an opportunity to tweak its policy. If 10Y UST yield were to pick up from here, it would make it even easier for the BoJ to allow 10Y JGB yield to rise above 10bp to support the Japanese banking system.

The timing of this policy shift remains unclear, but an indication of a higher yield target would be JPY bullish in our view.

Moreover, our recommended trade has limited downside (we are long an AUDJPY put funded by AUDJPY call spread).

Buy EURNZD at 1.7248, stop at 1.7156.

Add longs in a 3m AUDJPY put, strike 77.50, short a 3m AUDJPY 81.25-83.50 call spread, spot reference: 82.250.

Short NZDUSD through a covered put. Take profits on short cash from 0.6893 for +0.88%, spot reference: 0.6795.

Stay short a 2m 0.6677 NZDUSD put. Courtesy: JPM, Westpac

Currency Strength Index: FxWirePro's hourly AUD spot index is at shy above 42 levels (which is bullish), while hourly NZD spot index is edging higher at 53 levels (bullish), USD is at 1 (neutral), JPY is at 45 (bullish) while articulating (at 14:07 GMT). For more details on the index, please refer below weblink:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch