The Turkish lira began weakening again. This is all the more noticeable against a generally favourable market environment for EM. We remind investors that every such development can potentially spiral out of control because the central bank does not really carry a credible rate hike option. We have long forecast USDTRY to surpass 7.00 when the next EM risk-off market move arrives, but it could happen sooner.

The VXY Global FX volatility index heads into 2020 with the deepest cyclical undershoot on record, in excess of 3 volatility points. The key changes vs. end-2018 are the starting level of vol (more than 2.5% pts lower, which positive for FX vol next year), no repeat of 2019’s 100bp+ US real yield rally that may have obscured some EM sins this year (again, this is positive for 2020 vol).

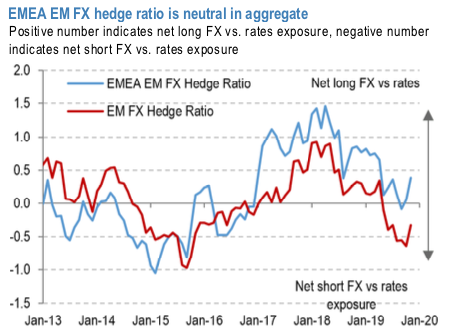

Valuations are overall cheap in EMEA EM, but this hides a substantial dispersion in individual currencies. Fundamentally strong currencies screen already expensive (RUB, ILS, CZK). Meanwhile, the overall cheapness is primarily driven by TRY, HUF, PLN and RON. However, for HUF and RON, we believe the model probably doesn’t accurately capture the overheating in these economies, while for TRY, FEER type assessments appear more appropriate. Separately, while the FX hedge ratio is globally quite negative, suggesting positioning would favor an FX rally, in our region the FX hedge ratio is neutral in aggregate (refer 1st chart). The only currency where the FX hedge ratio is materially negative is ZAR, which is one of the reasons we prefer not to be UW the currency despite our medium term bearish stance on the Rand. Please be noted that the EM FX Hedge Ratio is defined as the EM FX Score minus the EM Rates Score. The EMEA EM FX Hedge Ratio is the simple average FX Score of CZK, HUF, ILS, PLN, RON, RUB, ZAR and TRY, minus the simple average Rates Score of Czech, Hungary, Israel, Poland, Romania, Russia, South Africa and Turkey. Latest value as of Nov-19.

In past periods of increased risk aversion it was often the usual suspects such as the Brazilian real, the Turkish lira or the South African rand that were particularly affected (refer chart 2 and chart 3).

However, there were also periods when this was not the case. That means this is not an automatic development. Depending on the specific situation in the different countries, domestic factors can push aside external risks. For example, the majority of EM currencies reacted negatively to Donald Trump’s election victory in November 2016, but the South African rand was able to avoid this general trend and was able to appreciate during the period in question. A glance at the development of the ZAR exchange rate against USD shows that ZAR initially reacted negatively to the event but that focus then returned to domestic factors. At the time the hope of an imminent end of the Jacob Zuma era and political change in South Africa allowed ZAR to appreciate.

We remain pessimistic about the lira’s medium-term outlook as Turkish monetary policy is progressively overhauled to represent President Erdogan’s unconventional economic views. We look for USDTRY to head to the 7.00 mark during the next EM risk-off move, perhaps at some point in 2020.

Hence, capitalising on any abrupt price dips, we reckon that it is the ideal time for deploying longs with a better entry level. On hedging grounds, USDTRY diagonal debit call spreads are advocated with a view to arrest both upside risks of the major trend and minor dips abruptly. Initiated 3m/1m 5.50/6.25 call spreads at a net debit. Thereby, one achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes. Courtesy: Bloomberg, JPM & Commerzbank

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts