OTC Updates:

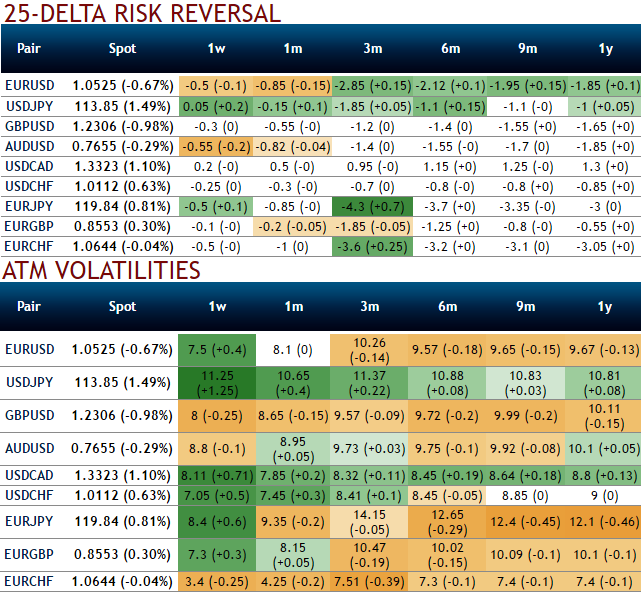

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While, the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

What drives bullish CHF:

The SNB continues to taper but at a faster pace.

The excess net private sector demand for CHF stands at 10% of GDP, which would likely cause the franc to appreciate by 5-10%in the absence of countervailing FX intervention.

The US Treasury cites Switzerland as a currency manipulator.

French elections - President Le Pen, CHF forecasts are predicted on Le Pen losing the French election and would need to be upgraded by at least 5% should she triumph (we attach a 15% probability to this scenario).

Data Events:

In Switzerland, the GDP has disappointed the streets, Switzerland's economy expanded 0.1 pct in the December quarter of 2016, the same pace as an upwardly revised figure in the third quarter and missing markets estimates of a 0.5 pct growth. The GDP growth rate remained at its lowest figure since the June quarter 2015. Year-on-year, the economy grew by 0.6 pct, slowing sharply from an upwardly revised 1.4 pct expansion in the September quarter and below consensus of a 1.3 pct growth. It was the weakest expansion since the fourth quarter 2015.

While retail sales data has managed to print the better than expected number, Retail sales in Switzerland shrank 1.4 pct year-on-year in January of 2017, following an upwardly revised 4.1 pct fall in the previous month and compared to market expectations of a 2 pct decline.

The US unemployment claims at around 13:30 GMT.

We advocate below both spot as well as option trades ahead of above data events:

Trade Recommendation:

Stay short a 3m strangle in EURCHF (sell a 1.0850 call and a 1.03 put).

Alternatively, stay short EURCHF in cash (first entered 1.0720 in December).

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons