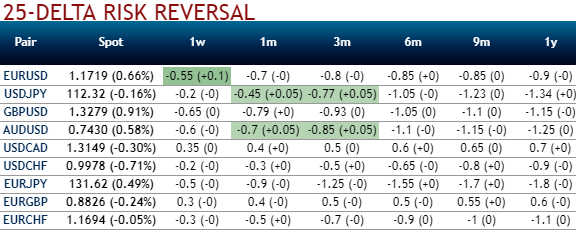

Please be noted that the positively skewed IVs of GBPUSD contracts of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.30 levels (above nutshell). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact.

GBP NEER has been locked into an exceptionally tight range, not so much because of an absence of developments, especially on the Brexit front, more that investors just don't know what to make of these, either for the end-game to Brexit or the remainder of the process. This inability to see through the Brexit fog means that GBP trade-weighted has not budged from a month ago; it’s also within half a percent of the average since the referendum. Equally impressive is the fact that 1m realized volatility in EURGBP is approaching its lowest level in a decade.

The lack of volatility in GBP together with the lack of visibility around Brexit mean that we’re neither forced nor inclined to change the GBP forecasts this month -these envisage modest near-term weakness in GBP vs EUR before a recovery vs USD over a 1Y horizon in keeping with the stronger EURUSD profile (1Y EURGBP 0.89, 1Y cable 1.37). But chances are the forecasts will need to be adjusted in coming months assuming that uncertainty surrounding Brexit eventually recedes and the central scenario to this saga becomes rather clearer (soft deal vs no deal vs delay/potential cancellation).

The UK government finally published its proposals for its future relationship with the EU following a cabinet showdown that resulted in the resignation of two pro-Brexit ministers resigning (the foreign secretary Johnson and the Brexit secretary Davis). The white paper targets a free trade area in goods based on a harmonized rulebook (the UK mirroring EU standards) and a 'facilitated customs arrangement'. By definition, this entails a softer Brexit for the goods sector, as it needs to be to address the Irish border issue, albeit for the services sector the proposals accept the inevitability of reduced market access, and hence a rather harder Brexit. Tempting though it may be to regard the government’s belated choice of proposals as a step in the direction of a softer Brexit, in reality, it does surprisingly little to improve visibility on the way forward.

Most significantly, it is far from evident that the UK’s proposals will be acceptable to the EU insofar as the UK is still trying to cherry pick in seeking a third way between the two options which the EU has offered the UK (a looser, Canada-style free trade arrangement, or a tighter EEA-style arrangement, the former with fewer privileges, the latter with greater obligations including the free movement of labor).

So whereas PM May is likely to have done enough to stave off a defeat in the Commons on the customs vote next week, and should have the votes to survive any immediate challenge to her leadership from disaffected pro-Brexit Tory MPs, she is still a long way from securing a withdrawal agreement with the EU and being able to pass this through the UK parliament. Courtesy: JPM

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure