As for monetary policy, we remain to be convinced that a modest increase in UK rates over and above what is now priced (we expect 50bp this year) will be a game-changer for GBP. Growth may have improved in the UK but the country is still a clear laggard within G10 and monetary tightening is merely reducing the highly negative level of real UK rates. The Brexit vote may not have reduced the current account deficit to a more normal level notwithstanding the collapse in GBP (the deficit is currently averaging 4.5% of GDP), but it has led to a collapse in long-term capital inflows and so presents the UK with short-term financing requirement of around 5.5% of GDP. Capital inflows of this scale can’t be assured with real policy rates still below -2%.

Nevertheless, the modest acceleration in UK growth to around 2% doubtless contributed to the reversal of speculative positioning in GBP from heavily short to heavily long (more so CTAs than macro investors we believe) as it led to a firming up of UK rate expectations (one and a half hikes are now priced for the end of 2018, three and a half by end-2020) and the promotion of GBP to the vanguard of currencies where central banks are in the early stages of policy normalisation.

Well, all these macros standpoints could propel GBPAUD either side but more downswings potential.

Consequently, in the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7928 levels, currently trading in non-directly to signal some bearish pressures. We advocate hedging strategy as stated below with cost-effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

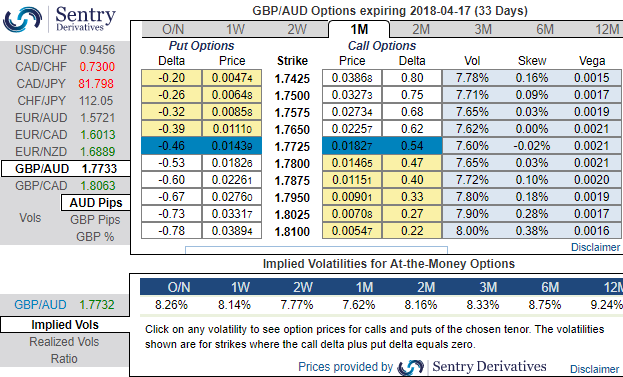

The execution: Initiate long in GBPAUD 1M at the money -0.49 delta put, long 1M at the money +0.51 delta call and simultaneously, short theta in 1w (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 1w IVs are just shy above 8.14%, whereas OTM calls of this tenor have been crazily overpriced above 25.85% more than NPV, hence, we foresee writing such exorbitant calls are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 20 (which is neutral), while hourly AUD spot index was at shy above -96 (bearish) while articulating (at 10:14 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data