The moves in Sterling at the beginning of the week give a good illustration of what might be to come if the UK really was to leave the EU without a deal. And they illustrate once again to what extent the BoE’s hands are tied by Brexit and BoJo (Boris Johnson). In its May inflation report, the BoE had still tried to convince the markets that interest rates might rise. That is unlikely to be up for debate again at the BoE meeting today or in the new inflation report. The market is already expecting rate cuts for the 9-month horizon.

As Brexit constitutes a considerable risk for the economy and currency the BoE simply has to wait how things progress and what kind of negotiation tactic BoJo will adopt. If Sterling collapses in case of a no, rate hikes might be necessary to support the currency and to prevent an inflation shock. On the other hand, a collapse of the economy as a result of a no-deal exit might require rate cuts.

At present, the BoE can only draft possible scenarios and their reaction functions. The BoE will continue to publish its forecasts for growth and inflation but as MPC member Michael Saunders suggested these "may not be a key driver” of the interest rate decision. It certainly makes sense to follow the BoE’s approach regarding possible Brexit effects, but until the vexed subject of Brexit is off the agenda its hands are tied anyway and monetary policy is not going to provide any stimulus for Sterling.

BoE is scheduled for their monetary policy for next week. Ongoing political uncertainty indicates a continuation of the ‘wait-and-see’ message regarding the timing of the next bank rate hike.

OTC outlook:

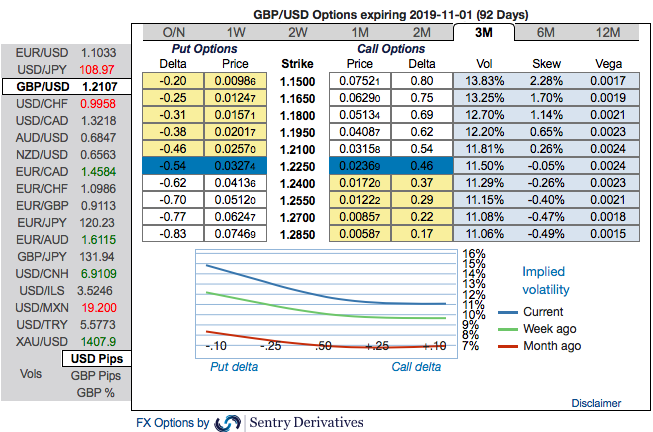

Negative bids have been observed in the GBPUSD risk reversals of 3-6m tenors. While positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes. To substantiate this downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments.

We reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short-run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in the long run by delta longs. Courtesy: Commerzbank, Sentrix & Saxo

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise