Rate-setters at the European Central Bank (ECB) meet in Frankfurt on Thursday. Their plan to conclude net bond purchases by the year-end, but to keep interest rates on hold “at least through the summer of 2019” was already outlined last month.

EUR is starting to stabilize following the succession of economic and political shocks that triggered the abrupt depreciation from late April. Importantly, the region’s economy is regaining its composure following the stumble in 1Q and political risk has receded if not been fully eliminated as Chancellor Merkel has survived the immediate crisis over migration policy even as the Italian government weighs its fiscal strategy.

By contrast, ECB policy has proved a modest disappointment for EUR as the last meeting deferred a hike until at least autumn 2019 even as QE is set to end this December, albeit subsequent commentary points to divisions in the council over the exact timing of the first hike. A series of data releases provided reasons for doubt whether the Bank of England will raise interest rates on the 2nd August.

Nevertheless, interest rate futures markets still attach close to 80% probability to an August hike. While it wise to ponder over BoE policymakers’ focus on the bigger picture rather than the most recent data releases, and that an increase is the most likely outcome. Previous experience suggests that the Bank is unlikely to want to surprise markets on the day, but with the pre-announcement blackout period due to start early next week, Bank policymakers only have a few days to impact on market pricing. Indeed Monday’s speech from BoE Deputy Governor Broadbent is the last scheduled public appearance by a Monetary Policy Committee member ahead of the August policy decision.

Brexit developments also continue to buffet the pound. This week the House of Commons eventually passed Brexit related trade and customs bills but only after considerable manoeuvring and some amendments.

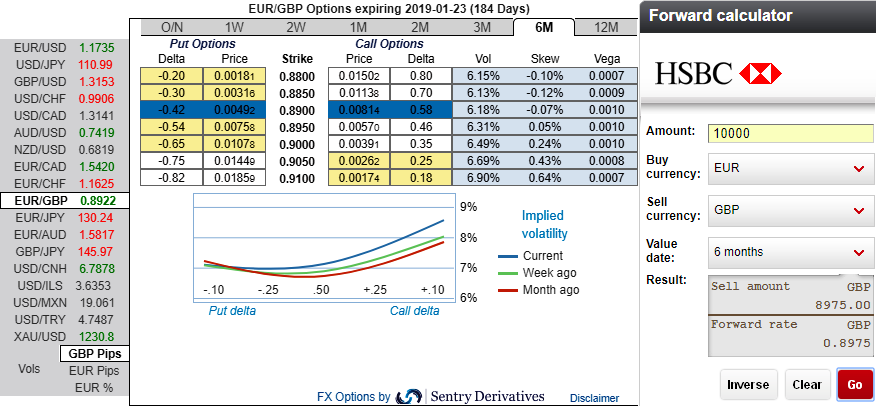

Considering all these fundamental factors, the foreign traders seem to be factored-in their EURGBP hedging perspectives via OTC markets. At spot reference levels: 0.8920, please be noted that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM call strikes upto 91 levels (refer above nutshell evidencing IV skews). As you could observe EURGBP forward rates, these derivatives instruments also indicate bullish targets of this pair.

Risk reversal of EURGBP is also signalling bullish risks in longer-term tenors, whereas, bearish risks in short-run (refer 1m/6m bids in above nutshell showing risk reversals).

Please also be noted that the implied volatilities of these combinations of tenors (1m and 6m), shrinking IVs in the 1m tenor that are supportive for call option writers and rising IVs in 6m tenors that are conducive for options holders.

While the current prices have nudged towards the top of the broad 0.8600 – 0.9040 trading range. Momentum seems to be little overbought signifying a consolidation should be seen, while a slide back through 0.8880-0.8840 support would suggest the range highs have held and we will grind back towards the range lows. Above 0.9040 next resistance is around 0.9155. Below 0.8840 support is in the 0.8720-.08690 region ahead of the range lows. Our bias is for the range highs to hold for a shift back to mid-range around 0.8800-0.8750.

Currency Strength Index: FxWirePro's hourly EUR spot index is at shy above 5 levels (which is neutral), while hourly GBP spot index is edging higher at 98 levels (bullish) while articulating (at 11:54 GMT). For more details on the index, please refer below weblink:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.