The South African economy expanded an annualized basis at 0.2 pct in Q3’ 2016, compared to an upwardly revised 3.5 pct growth in the June quarter which is well below market projections of a 0.5 pct expansion. It was the second straight quarter of growth, mainly supported by mining, general government services, and real estate activities while manufacturing shrank.

The economy on YoY basis grew by 0.7 pct, slightly faster than a 0.6 pct expansion in the previous three months and in line with consensus. It was the strongest growth since the third quarter of 2015.

High unemployment and continued high inflation are likely to have dampened private consumption. Moreover, the continued low commodity prices are likely to have put pressure on production in the mining sector.

Even though South Africa has just avoided a downgrade to junk status as another important rating agency, S&P, left its rating for South Africa unchanged albeit still with a negative outlook.

The continued political uncertainty surrounding President Zuma who is crippled by the accusation of corruption remains a large risk. If the government does not achieve a turnaround with the structural reforms and records economic growth there is a risk that the country will be downgraded to junk status next year. Even though the rand was able to benefit from S&P’s decision short term, it remains at risk.

FX Option Strategy - Diagonal Call Spreads (DCS):

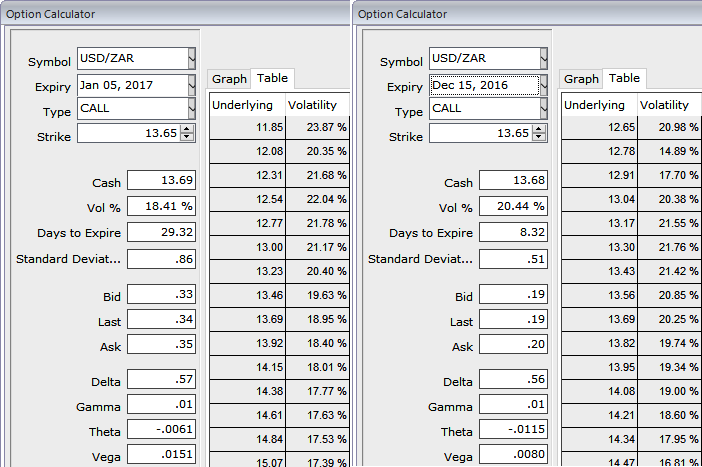

We upheld the long positions in USDZAR in option spreads with diagonal expiries, cash trades were not preferred on account of high yield IVs, 1m ATM IVs are spiking shy above 18.41% and 20.44% in 1w tenors which is a good sign for option holders.

Anticipating further price upswings in the underlying spot of USDZAR, on hedging front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

In naked vanilla form, we suggest credit call spreads types at the 1M horizon but with a diagonal tenor pattern, optimizing strikes for leverage. In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility