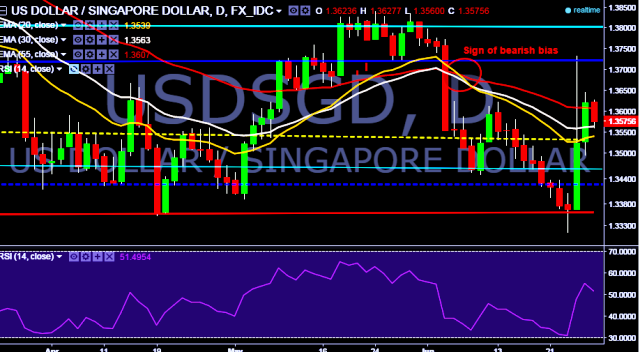

- USD/SGD is currently trading around 1.3575 marks.

- It made intraday high at 1.3627 and low at 1.3560 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.3627 levels.

- A daily close below 1.3535 will drag the parity down towards key supports at 1.3357 (April 20, 2016 low)/1.3318/1.3302/ 1.3271 levels.

- Alternatively, reversal from key support will test key resistances at 1.3646, 1.3799, 1.3836, 1.3851(March 16, 2016 high), 1.4073 (20D EMA) and 1.4132(20D, 30D and 55D EMA crossover).

- Important to note here that, 20D, 30D and 55D EMA heads down and confirm the bearish trend.

We prefer to take short position in USD/SGD around 1.3585, stop loss 1.3646 and target 1.3458 marks.