Brazil’s long-awaited exit from recession took a step back this week, with a disappointing set of August activity data leading us to lower the growth projection for Q3’16 even though we still see a tepid recovery starting this quarter. At the same time, COPOM began its easing cycle this week but did so with a less-than-expected 25bp cut and adopted a more hawkish tone in the post-meeting statement.

The committee conditioned the pace of future cuts on the implementation of fiscal measures and the behavior of cyclically sensitive services sector prices. As we do not foresee an immediate improvement on these fronts, we moved our November call to a25bp cut (from50bp).

However, we see an increase in the pace of cuts after Congress finalizes the approval of the spending cap bill and makes progress on pension reform. We now anticipate that the CB may cumulate 300bp easing by mid-2017.

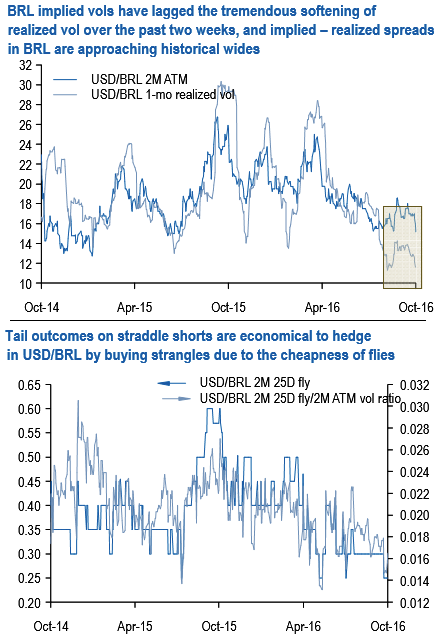

There are a few gamma shorts as convincing as BRL at present. USDBRL implied –realized vol spreads are stunningly wide (4w ATM – 4w hourly realized vol in excess of 7 % pts., 4.5 pts. if using close-to-close WMR measurements), and the leak lower in implied vols, even accounting for this week’s intense sell-off, has severely lagged the catastrophic decline in realized vol this month (see above chart).

The latter is due only in small part to the beta effect of the global compression in FX vol towards YTD lows; there is a larger, more important idiosyncratic component to the real narrative in that spot ranges have shrunk in the tug of war between attractive Brazilian real rates that have continued to fuel solid FDI and equity inflows and a still inexpensive currency, versus a considerably priced-in macro-recovery story, expectations of BCB rate cuts and still-extant fiscal uncertainty.

The new piece of information this week was that monetary easing that got underway this week is unlikely to derail the currency, judging by BRL’s positive response to a hawkish-sounding COPOM message (Hold BRL longs as the easing cycle kicked off with a ‘hawkish’ tone).

A slow grind lower in USDBRL towards 3.10 from here is likely to pressure front-end vols materially lower to reflect the exorbitant decay cost of owning options, and we sell delta-hedged 2M straddles to participate in the vol crunch.

For investors who would rather avoid the hassle of delta hedging and sell vol in management-lite capped loss format, we propose either (a) short straddle vs. long strangle spreads or (b) double no-touches. Both structures benefit from depressed levels of vol flies (see above chart) that render owning wings to eliminate tail losses of selling ATM vol an economical proposition.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close