Since January, the EURUSD has essentially been driven by the S&P realized volatility, while US short rates explain it only when the influence of equity volatility is removed.

Fed's fears mean higher yields and vulnerable US equities (strong negative correlation), which implies higher S&P volatility; this, in turn, leads to a lower EURUSD.

Thus, we think that it is wise to fetch 8-9 times leveraging effects between 1.0450 and 1.0750 selling the bottom of the range.

Fundamentally, a December hike would not come as a complete surprise, so that the EURUSD is unlikely to break 1.05.

We, therefore, advocate setting a downside KO at 1.0470, just below the multi-year low at 1.0458 (16 March 2015).

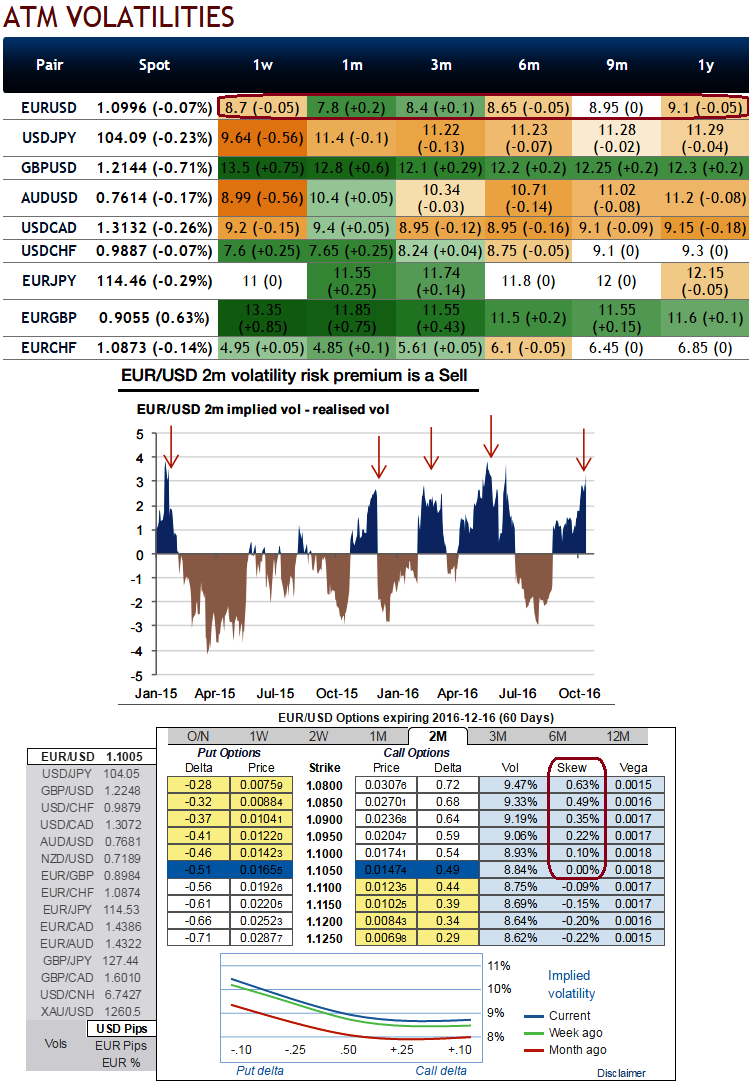

As you could observe the positive skews signify the OTC FX hedging interests towards OTM put strikes, the negative skew drives in downside volatility, so that such a barrier appealingly discounts put options.

Shorting expensive volatility is the smart option trade idea in this scenario. Instead of targeting the exact level where the EURUSD would head in next two months in a bearish scenario, we trade a sub-range, namely the portion of the full range below the 1.08 support.

A digital put is similar to a very tight put spread around the strike so that the option is short vega on the downside.

Well, the execution goes this way:

Buy EURUSD 2m digital put (European style options), strike 1.0750 KO 1.0470 with the indicative offer: 10% (vs 23% without barrier spot ref: 1.1010). The EURUSD option with 2m tenor encompasses the Fed meeting in December.

With the RKO barrier, the exotic option becomes fully short vega, no matter the spot level, which is convenient, as EURUSD 2m implied volatility is trading significantly above the 2m realized volatility.

The risk is limited to the extent of premium, the investors buying a digital put with a knockout cannot lose more than the premium paid in the event of EURUSD touching 1.0470 on expiration (i.e. at any time within the next two months), or trading above 1.0750 in exactly two months.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge