What's cooking with JPY fundamentals: The Bank of Japan (BoJ) decided on surprise measures to qualitatively supplement its QQE without further quantitative easing last week (BoJ reinforces open ended character of QQE without further quantitative easing).

Governor Kuroda at the post-meeting press conference described the decision as a supplementary adjustment rather than additional easing.

Yet, market reactions seem to reflect confusion and concerns about the BoJ's policy communication, which may continue to weigh on USDJPY in the near term as post-Fed gains are being erased.

Data on the focus for today: CPI, unemployment claims, household spending and housing strats are scheduled for today.

On the flip side, the RBA is not yet out of the woods. In particular, as long as China is struggling, a further rate cut is possible.

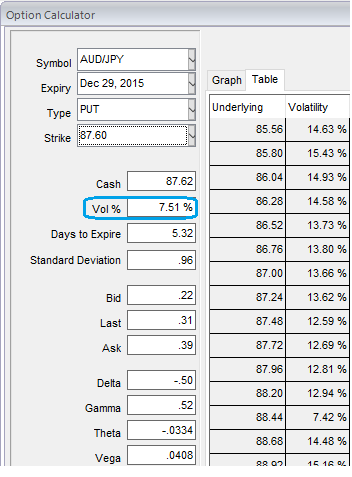

Higher Implied Volatility and Put Ratio Back Spread: AUD/JPY

We know that the options with a higher IV cost more, intuitively due to the higher likelihood of the market 'swinging' in your favor.

The implied volatility of ATM AUDJPY puts of near month contract has reduced from 12.39% to 7.51% that is good sign for option holders (as a result reduced weights in back spreads after benefitting from 2:1 ratios).

You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Traders tend to view the put ratio back spread as a bear strategy corresponding to the current weakness in this pair, because it employs puts. However, it is actually a volatility strategy also. The implied volatility of 1M ATM put contract is at 7.51% and it is quite reasonable to accumulate more.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

Entering into the above recommended AUDJPY positions when implied volatility ticks at around 7.51% and expecting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: Rosy times for AUD/JPY put holders as reduced IV favors vega, 2:1 backspreads to reduce hedging cost

Thursday, December 24, 2015 8:04 AM UTC

Editor's Picks

- Market Data

Most Popular

9