The FOMC is likely to enact a 3rd hike in the federal funds rate this week. On Wednesday, March 15, the FOMC is likely to hike its funds rate by 25 basis points for the third time during the current economic expansion.

As a result, rotation of CAD shorts from NOK to USD are advised in view of the upgrade in US rate expectations and the lack of momentum in NOK fundamentals at present.

We acknowledge long USDCAD has been a frustrating consensus trade since the US elections but believe there’s a better chance of it working now that CAD positioning is as long as it was short just after the presidential election, while the BoC’s campaign to get investors to differentiate between Canada and the US and to decouple CAD from USD is bearing fruit (see above chart).

Stay short in CADNOK at 6.35 with a strict stop at 6.5725, while simultaneously, encouraging longs in USDCAD at 1.3430 via below option strategy stop at 1.3045.

USDCAD Call Ratio Back Spreads: hedging vehicle to sync with OTC indications

Well, as implied vols are rising amid central bank’s hiking cycle (US Fed) which is highly significant data circumstance for USDCAD, if you ponder vanilla structures are risky ventures, options spreads like positions are more conducive as the underlying spot FX is still hovering around all-time highs. The traders tend to view the call ratio back spread as a bullish strategy because it employs calls.

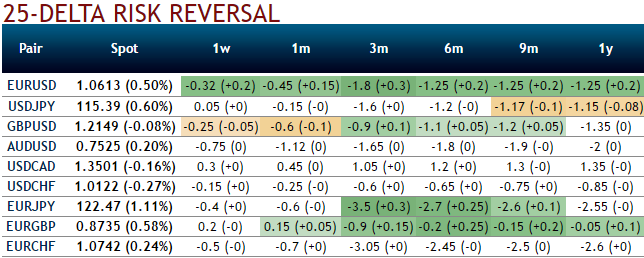

However, it is actually a volatility strategy. Synchronizing both risk reversals and IV skewness of 3m tenors while we uphold longs via ATM calls in below options strategy to hedge the upside risks of this underlying pair.

Hence, we advocate initiating 2 lot of 3m ATM +0.51 delta call, simultaneously, short (1%) OTM call of 1m expiries. One could achieve positive cashflows as the underlying spot keeps spiking.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis