Despite the breakdown in trade talks between the US and China at the end of last week, which saw the US increase tariffs of $200bn worth of Chinese goods to 25%, broader market sentiment seems to have stabilized. US equities are finding buying interest on the current pullback, while the USD vs G10 remains in its short-term range.

While the lingering BoC and USMCA risks give a clear directional bias for CAD. Meanwhile, medium-term view on NOK is modestly bullish on gradual rate hikes. The setup is favorable for financing CAD downside by selling NOK downside, especially considering that our swaptions-FX vol framework sees value in CAD options ownership and instructs us to sell NOK options.

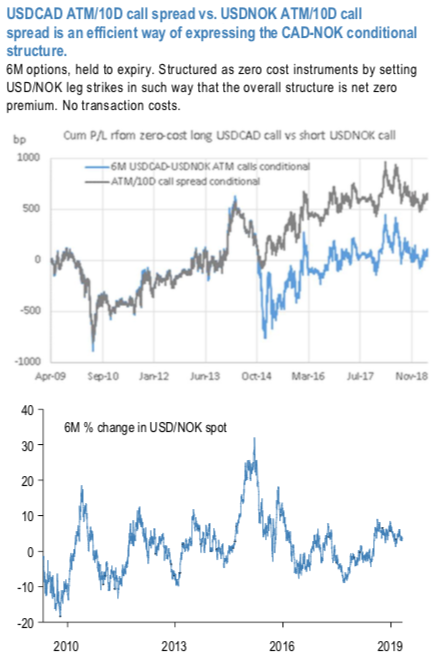

One additional twist is in utilizing call spreads instead of unlimited downside call conditionals. Even though still at very modest levels, the ratio of OTM USDCAD calls to ATM calls is at the highest in almost 2 years, suggesting value in selling OTM strikes in form of call spreads.

The construct outperformed the standard USDCAD ATM call vs USDNOK ATM call, as the loss-capping mechanism intervened on the short USDNOK leg during the massive USD rally in 2014 (refer above chart). Other than loss capping, the structure shows nearly 100% exposure to the historically observed upside, with USDCAD skew historically underperforming.

Trade recommendation: Buy 6M ATM/10D USDCAD call spread, financed by shorting 40D/7D USDNOK call spread, in a zero cost structure, not delta hedged. Courtesy JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards 55 levels (which is bullish), while hourly USD spot index was at -34 (mildly bearish) while articulating (at 11:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields