Reports that Canadian officials see an increased likelihood of the NAFTA negotiations failing, causing the US to leave the trade agreement, dealt CAD and MXN a severe blow last night. While MXN was able to largely retrace its losses following denials from the White House that the President’s position had not changed, CAD is still trading at notably lower levels this morning. The reports make a Bank of Canada (BoC) rate hike at next week’s meeting less likely as a possible end or even just a curtailment of the NAFA agreement would have far-reaching effects on the Canadian economy.

Canada has been dealing toughly with the United States, underlining heavily on its determination to push back against what it says are unfair trade practices ahead of crucial talks to revamp the tri-nation North American Free Trade Agreement, while President Donald Trump has endangered to abandon unless major changes are made.

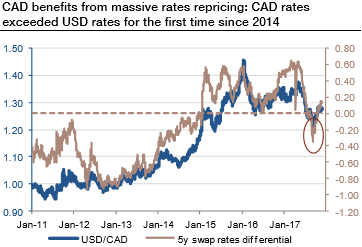

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer 1st graph), and our USD rates projections can realistically drag the USDCAD to 1.20.

Now that it has become known that the NAFTA negotiations are not on a path towards success at all the BoC might refrain from further rate hikes so as to avoid putting additional pressure on the Canadian companies with higher interest rates and as a result a possibly stronger CAD.

On a related note, we like relative value constructs with CAD or MXN vol as the long leg. One that looks interesting to us at present is a CAD vs. RUB vol spread. The construct appeals because it –

a) is largely neutral to oil price developments, so offers a slightly different risk profile to existing bullish RUB carry positions in the portfolio and

b) enjoys more than 2 pts. of ex-anteimplied -realized vol carry (refer above chart), which mitigates to some extent the negative of less-than-stellar entry level on implieds. The RV edge can be further magnified by deploying OTM USD calls instead of ATMs: USDCAD risk-reversals are materially more depressed than USDRUB even adjusting for base vols (CAD 3M 25D RR 0.4, RR/ATM ratio 0.06; RUB 3M 25D RR 2.6, RR/ATM ratio 0.26) and discount little trade tension anxieties; the additional smile theta of the RUB leg is worth earning in our view in a rising oil price environment when RUB puts are unlikely to be called into play. We open a 100:65 vega-weighted (premium neutral) long CAD vs short RUB 3M 35D USD call switch. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -92 levels (which is bearish), while hourly CAD spot index was at shy above -115 (bearish) while articulating (at 07:43 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data