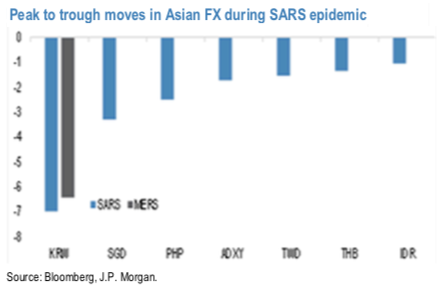

USDKRW continues to demonstrate that it remains the key risk barometer for FX in the region. During the height of the SARS epidemic, Q1 2003, the peak to trough move in the ADXY was -1.71%, although the impact was quite varied across the region (refer above chart). KRW FX saw the largest decline, followed by SGD and PHP FX, whilst TWD, THB and IDR saw much milder falls. CNY and MYR saw no discernible impact (even in the forwards), as both currencies were still pegged against the USD at this time, whilst USDINR spent the majority of Q1 and Q2 in 2003 trending lower. Of course, it is important to note the context differences between then and now. In Q1, 2003 the Korean current account surplus slipped into deficit and was only marginally back in positive territory by Q2. In the current context this is unlikely to be repeated, with the Korean current account surplus closer to 4% of GDP at the moment.

However, we would still see the won as vulnerable to further selling pressures if coronavirus fears escalate. Korea has strong links to the China economy via goods trade but also receives just over one-third of its total tourism arrivals from China as well. As we outline below, whilst the overall level of tourism as a share of GDP is quite low, the market will still be concerned about what the outbreak does to an already soft domestic demand backdrop. Indeed, during the Middle East respiratory syndrome (MERS) outbreak in South Korea through May-July 2015, USDKRW rose by just over 6%.

During this period, external demand was slowing down, so that no doubt contributed to the USDKRW move higher. Importantly, the current account surplus was in the 7-8% range during this time; hence, the current surplus should not be an impediment to further won weakness in the current environment.

At present, we have short exposure to KRW via a long TWDKRW 6 month NDF position and our sell/buy 03- Feb-20/29-Apr-20 USDKRW 1200 OT call calendar spread. Offsets to won headwinds can still emerge from the better cyclical backdrop, particularly in terms of the tech cycle, with DRAM prices starting to drift higher. JPM’s equity analysts are quite upbeat on the outlook for the outlook for the memory market this year. Equity inflows, whilst recovering since the start of the year, are still modest on a sequential three-month basis which, in turn, can limit the size of the USDKRW up move.

Well, all in all, this sees us exit the USDKRW call calendar spread, which was initiated with the intention of remaining exposed to medium-term US/China trade stress while earning time decay.

At current market, the structure has realized almost 100% of the ex-ante static carry offer, even as the intensity of the trade conflict has ebbed for now; hence, the decision to take profit. Entry level was +14% and we exit at +29%. We still maintain some short KRW exposure via the TWDKRW 6 month NDF position. Courtesy: JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges