Quant (QNT) is an Ethereum token used to power Quant Network’s Over-ledger brand of enterprise software solutions, which aim to connect public blockchains and private networks.

According to Cryptoquant, exchange reserves dropped to the lowest level since mid-July. Network activity surged sharply and hits its highest level in a year.

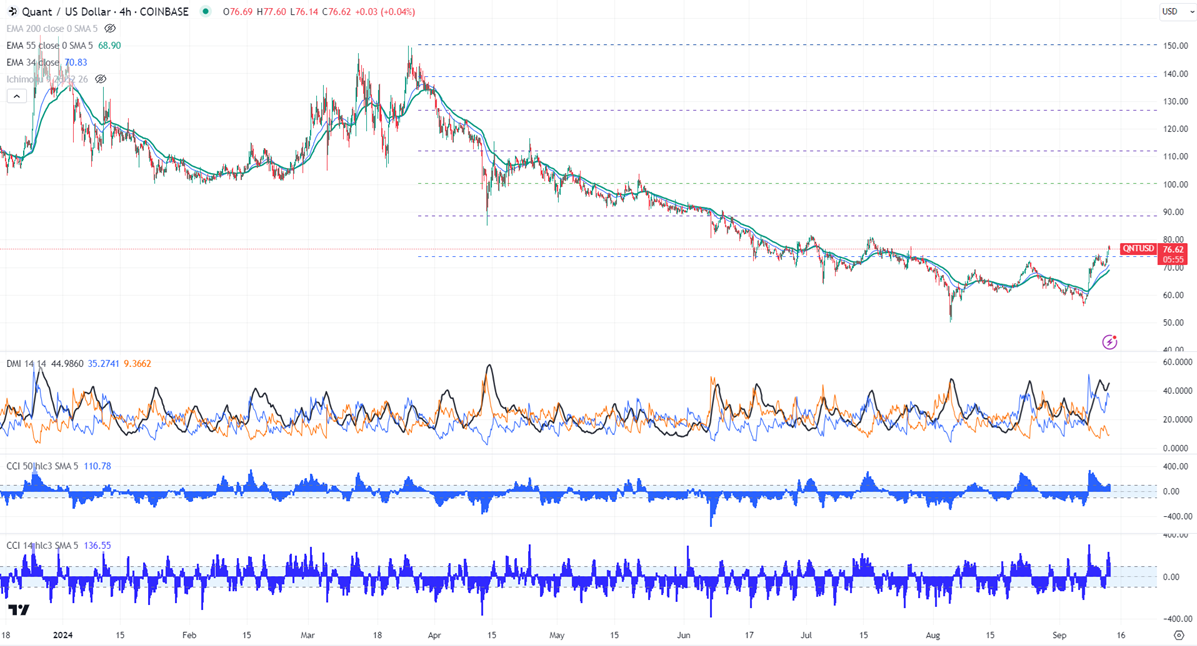

QNTUSD recovered after a minor sell-off.

Any daily close above $2.20 confirms bullish continuation.

QNTUSD jumped nearly 40% in the past one week. The pair holds well above the short-term (34 and 55 EMA) and long-term moving average. It hit a high of $78.02 and is currently trading around $76.61.

The bullish invalidation can happen if the pair closes below $50.On the lower side, the near-term support is $70. Any break below targets $66/$55.

The immediate resistance stands at around $83.Any breach above confirms bullish continuation. A jump to $88/$103 is possible. A surge past $120 will take it to $150.

It is good to buy on dips around $65 with SL around $50 for TP of $100.