This is just a review of the short put ladder option strategy that was advocated on exactly a week ago (14th June).

Before we begin please follow below weblink for our previous option recommendation on this pair:

The updates on OTC EURJPY are as follows:

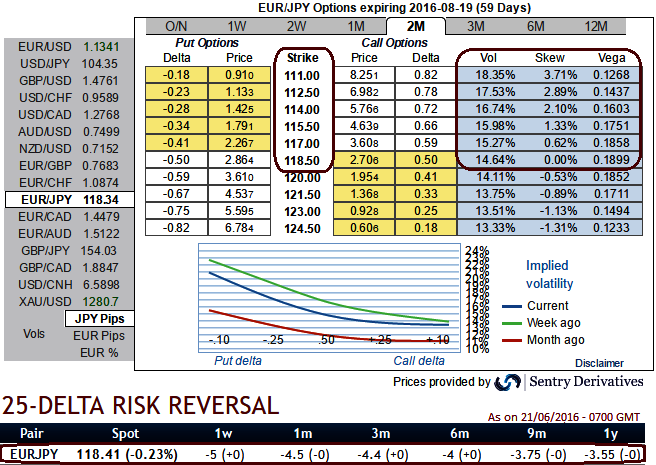

The current IVs of ATM contracts are at 16.55% and likely to spike higher levels above 27% in 1w and 2w tenors ahead of UK referendum this week, it is likely to perceive at 16% thereafter during 1m tenors.

While delta risks reversals have bearish-neutral right from 1w to 1y tenors that mean overall hedging sentiments favor bearish risks even though there are positive flashes. So, one can expect abrupt upswings in between the long lasting downtrend.

Eyeing cautiously on any abrupt upswings in EURJPY and spiking IVs would be conducive for option writers, shorts have been favored by acknowledging the implied volatility spiking when positive flashes keep popping up (see IV nutshell on every positive flashes of risk reversals).

Thus, please be noted that the shorts of 1w expiries are performing better so far.

2 lots of longs of 2m tenors would take care of downside risks signaled by the negative risk reversals of EURJPY in a long run during significant Brexit risky event.

As the delta risk reversals have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term, it encompasses many risky events in both short and long run that could pose potential headwinds for sides of this pair.

As stated in our earlier call, the risky event (Brexit event) could hamper euro’s prospects. Given concerns over limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long term hedging.

For now, stay firm with longs in ATM puts with 2m tenors as EURJPY is forecasted to retest 3 and a half year lows of 115.497 levels.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge