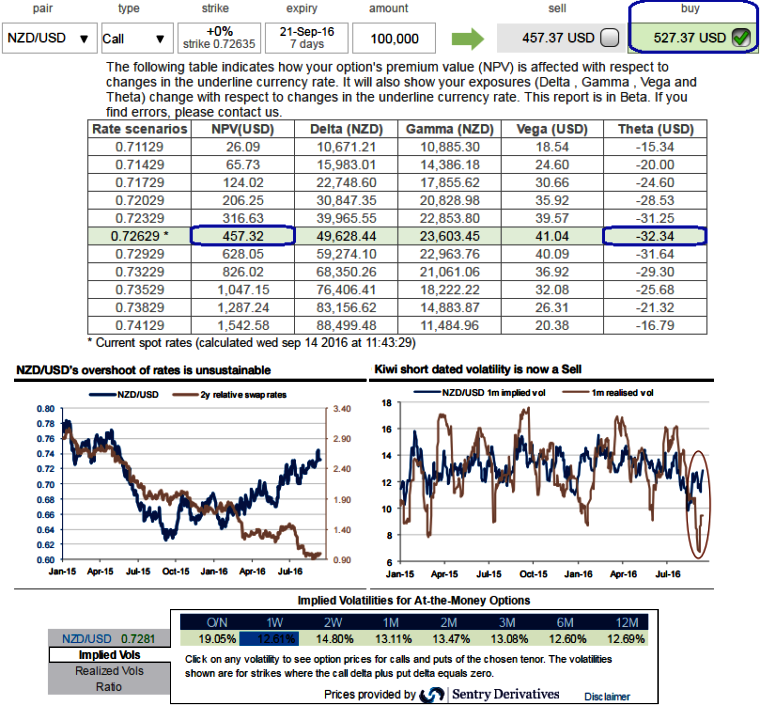

1w implied volatilities are flashing at 12.61%, while ATM calls of this time frame are priced at 15.38% more than Net Present Value. Hence, these call options are deemed as overpriced in prevailing bearish environment.

Expensive implied volatility and spot within a channel Implied volatility is elevated compared to realised volatility (see above graph), suggesting a structure selling it.

The downside skew is not sufficiently elevated to finance a put via low strikes (a put spread-like structure), but the negative skew is enough to obtain an attractive discount via a downside knock-out.

Such a barrier is appropriate for trading moderate NZDUSD downside, keeping in mind that the spot has been trapped within a bullish channel since the start of the year and that 0.70 is below the support line.

NZDUSD’s appreciation has occurred against the direction of interest rate differentials for months, and the disconnection recently widened with the latest bout of currency strength (see above Graph).

Hence, we think call writing could also be beneficial as IV skewness is conducive for prevailing bearish environment.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential