Clinton’s lead in the polls is rapidly dwindling – the Real Clear Politics polling average shows Clinton is ahead by a meagre +1.7pp, compared to nearly +8pp a couple of weeks back but in the recent past, Trump gaining traction is adding pressure.

The MXN is in the eye of the storm and will move a lot regardless of who wins - this is being reflected in the vol market; skew is heavily favoring dollar calls and implieds have been bid up significantly in short-dated tenors (1w vol is currently around 44).

The risks are asymmetric – a Trump win is more negative than a Clinton win is positive. In a Clinton win, USDMXN probably trades down to 17.5 in the ensuing days with a move to 16.5 dependent on a non- election boost to EM sentiment. In a trump win, USDMXN breaks 20 fairly quickly and could go as high as 23.

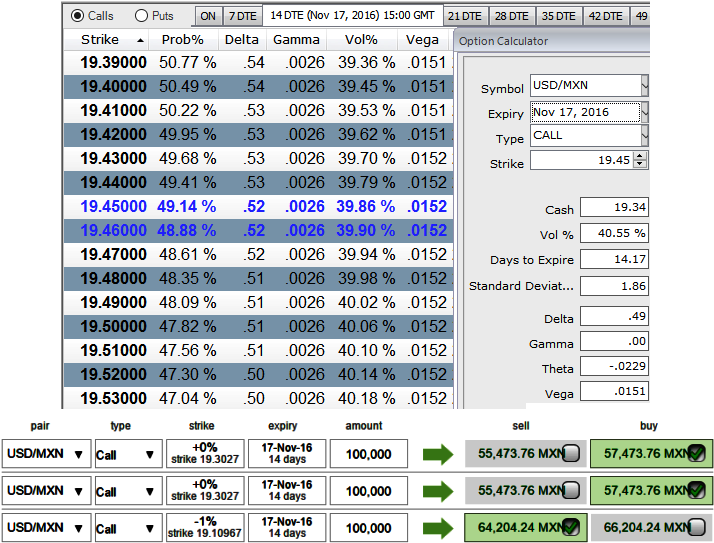

In this write-up, we run you through the significance of the Vega Calls in Back Spread to capture both dips in short run and extended uptrend in HY IV environment.

ATM IVs of this exotic Latin American pair of 2w expiries are spiking crazily above 40%, while vega flashes steady and higher positive numbers that signify OTC sentiments are more concerned about upside risks ahead of the US elections.

Vega is generally larger in options which have the longer time until expiry, and it falls as the option approaches expiry. This is because an increase in IV is more beneficial for a longer term option than for an option that would expire in shorter tenors. The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM which is why we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) with comparatively shorter expiry in the ratio of 2:1. Thereby, short term dips would be taken care by shorts and long vega calls capitalize on IVs to hedge upside risks.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cashflows.

The lower strike short calls seems little risky but because IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

We think, although Mexican currency is attempting to recover in its prices in abrupt dips in this pair, the above stated US election news and Fed’s hiking expectations during Christmas in addition, engulf with the uncertainties.

The robust uptrend and higher IVs would mean the market reckons the price has huge potential for large movement in the upward direction.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data