The price action in front-end vols over the past two days would be characterized by our Technical Analysis colleagues as a "break alert". In hindsight, this could have been predicted given the importance placed on this week beforehand by market participants. The Fed hike was telegraphed, and market positioned for it. The Brexit process doesn't elicit a great deal of FX hedging given the poor standing of short GBP positions.

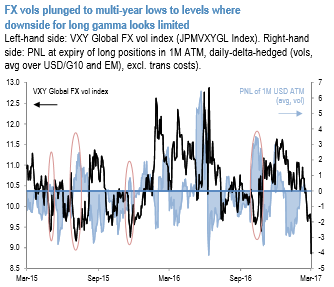

Last but not least, Dutch elections reassured the market that anti-EU populism was contained and well gauged by polls, at least in the Netherlands. This is leading to the sharpest drop in vols in years. The gauge of 3M USD vols, the VXY Global, has broken below 9 even accounting for French election risk, to levels usually associated with decent gamma performance (see above chart).

In the year-ahead outlook, we had flagged the consensual nature of the market’s long vol bias as the main risk for that view. The dynamic drop in vols at hand indicates a market scrambling to cut decay, where dealers exacerbate the dynamics of investor flows. The light schedule ahead of us seems to justify such stance, however trading being a “buy low –sell high” game, the downside from picking up cheap vols from current levels seems limited, and it is justifiable to look for the best value gamma buys at these levels.

The above table illustrates that vols in NZDUSD, AUDUSD, and USDCAD have dropped to such historical lows, that positioning long front-end vols in those pairs does make sense. In fact, gamma trading in those pairs have been skewed positively (PNLs have been positive on average over the past two years), and it would take a regime shift in vols to upset these positions.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms