When the tide and wind are moving in opposite directions, the sea is rough and sailing is hard work. The wind is in the euro’s sails, pushing it higher as the economy grows, the ECB edges away from post-GFC policies and the currency’s undervaluation support it.

We continue to forecast decent underperformance from NZD as the RBNZ is firmly on hold in our opinion, but we recognize that there isn’t a preponderance of near-term catalysts for a weaker NZD now that housing and credit trends appear to be stabilizing in NZ.

In addition, the market seems inclined to interpret commentary from the new RBNZ leadership through a hawkish filter. In all, we will review the medium-term premise for this trade in coming weeks.

EURNZD and EURAUD strike us as good value with little/no event risk premium roll-off exposure alongside EURMXN where gamma has been consistently realizing and which has an additional kicker from the upcoming 7th round of NAFTA negotiations and since recently tougher US stance on trade.

The Kiwi is expected to lose its pole position in terms of offering the highest central bank policy rate in G10 next year, and this should keep the currency a laggard. Moribund milk powder prices should also continue to drag on the currency.

Hence, we pair EUR against NZD to neutralize the risk to EURUSD from a further repricing of the Fed. The RBNZ is an unlikely candidate to signal tighter policy as the slowdown in migration intensifies the downturn in housing and argues against a policy response to upside inflation risks from minimum wage increase etc.

The RBNZ is therefore expected to stay on the sidelines through 2018 in the face of the institutional changes and countervailing fiscal effects.

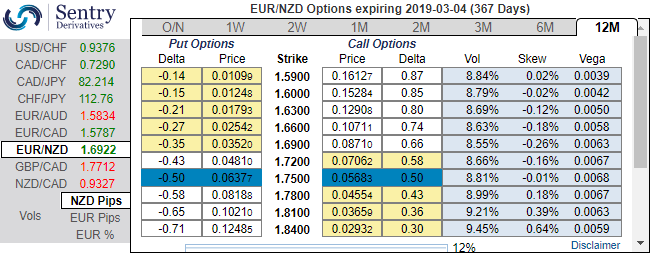

The positively skewed IVs of 1y tenors of this pair signify the hedging interests for the potential bullish risks in the months to come. Hence, we advocate long in a 9m 1.80 EURNZD AED call with a 3m 1.80 window KO. Paid 17.5%. Marked at 19.3%.

This trade is marginally in the money as the slight decline in the spot since we bought the call has been offset by the positive carry from the inclusion of a 3-month window knock-out. That window has now expired, and we are left with a clean 6m AED on EURNZD.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 64 levels (bullish), while hourly NZD spot index was at -99 (bearish) while articulating at 10:55 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand