It seems nobody can stop EUR rally for now, which might have created a problem for corporates that need to import from Europe. For automakers operating in China in particular, as they have to import many auto parts from Germany, the elevated EUR-CNY, which is close to the highest since 2017, probably means that they have to suffer more FX pains than usual. However, this again reflects the importance of FX hedging.

On a related note, U.S. Trade Representative Robert Lighthizer says he feels “very good” about the phase one trade agreement with China, which is doing a good job of honouring the pact amid the coronavirus pandemic. China this week bought more than $100m of U.S. soybeans, Lighthizer says. Overall, this will help somewhat ease the recent US-China tensions.

CNY’s influence and centrality within global FX has grown relative to other reserve currencies, particularly over the last five years. This suggests that, given the current tenuous state of US-China relations, the broad dollar should remain well-supported as USDCNY moves higher. But this relationship has broken down somewhat this month; a material negative catalyst could help the broad dollar establish a floor.

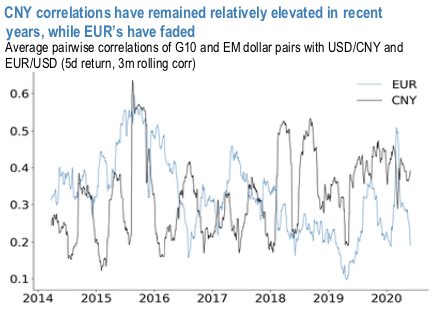

Since 2015, the broad dollar has shown a considerable sensitivity to changes in USDCNY, indicative of the scale of CNY’s expanding influence in FX. What this arguably reflects is a divergence in FX centrality over recent years, with EUR seemingly playing a diminishing role (refer 1st chart). CNY correlations by contrast have remained elevated in the new protectionist paradigm and thus offer some evidence of a shift away from traditional reserve currencies as the center of the FX universe. Yet this relationship between USDCNY and the broad dollar has not held firm in May, with the month-to-date change in the broad dollar undershooting its beta to USDCNY by two standard deviations (refer 2nd chart), prompting the question of under what conditions a move higher in USDCNY might provide support to the dollar on a broad basis.

Empirically, it seems that CNY’s influence on global FX is most acute during regime change and sharp deceleration, rather than breaches of nominal USDCNY levels. Pairwise correlations were relatively contained in 2019 even when USDCNY broke 7.00 despite the significance ascribed to that level (refer 3rdchart).

At this juncture, we uphold our shorts in CNH on hedging grounds via 3-month (7.00/7.25) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: JPM & Commerzbank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand