Bearish NZDUSD Scenarios below 0.56 if:

1) Agricultural commodities are dragged lower by the fall in oil prices;

2) Lower rates and RBNZ credit support to banks prove insufficient to stop a rise in housing arrears due to higher unemployment.

Bullish NZDUSD Scenarios Above 0.62 if:

1) Fiscal easing becomes large enough to remove the projected output gap for 2021;

2) The terms of trade prove resilient due to supply impediments in global goods trade and elevated demand for high quality food products.

The RBNZ is working hard to keep its mantle of most overtly FX-targeting DM central bank. We lower our NZDUSD targets from 0.60 to 0.59 for 3Q’20, and from 0.61 to 0.58 for 1Q’21.

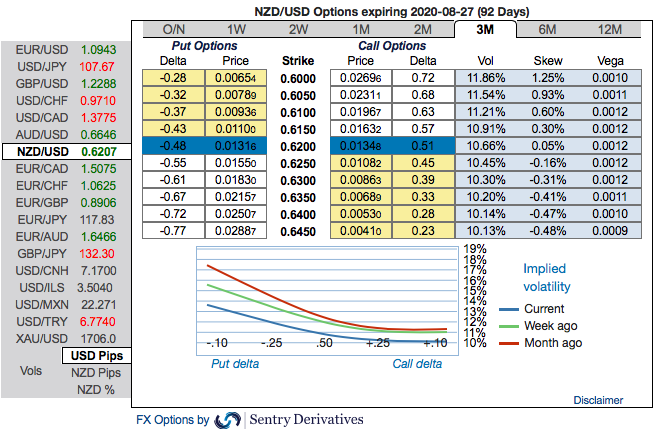

OTC Indications:

OTC Updates and Hedging Strategies:

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 10.13 – 11.86%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs still signals extreme downside risks, bids for OTM put strikes are quite visible (up to 0.60 for these tenors, refer above chart). Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated on RBNZ’s post monetary policy effects, the strategy is designed to mitigate the downside risks with a reduced cost of trading.

The execution: Short 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend short hedges staying shorts in NZDUSD futures contracts of June’20 delivery with a view of arresting bearish risks in the major trend. Courtesy: Sentry & JPM

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms