Gold gamma vol trading: we recently published a long/short gold gamma trading machine learning model that utilizes vols, option implied flow and risk sentiment in making near term predictions about implied-realized gold vol performance. The model is currently expecting realized vol to tactically firm up and perform (above chart - note that a negative P/L indicates preference for long vol position).

Alternatively, long front end FVAs (e.g. 1M1M) may be worth considering, being a good value, offering 0.7pts RV over an outright vol and protecting from a soft patch in realized vol while providing maintenance free exposure.

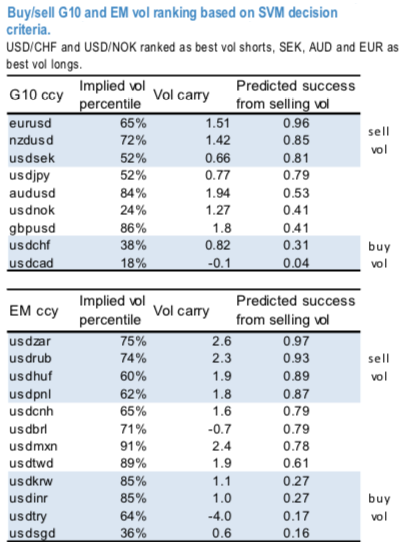

With NZD vols screening as one of the top sells on the SVM G10 model ranking in refer above nutshell, we like financing long gold gamma with selling NZD gamma vols. The long/short structure minimizes time decay while maintaining the long gold gamma vol upside. The recent run of economic data has been strong, and speculators are extremely short NZD. That should propel NZD higher in the near-term, to 0.6850. Multi-month, though, our expectation that the US dollar will continue to strengthen, as the Fed hikes four more times over the next year, The RBNZ shifted back to a neutral bias (from an implicit easing one) at the Nov MPS, following a strong run of data. It expects to remain on hold over the next year at least. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR is inching at 54 (which is bullish), USD spot index is flashing at -78 levels (which is bearish), while articulating (at 13:02 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One