As we have the flurry of data releases in Canada, we foresee option trading opportunity in NZDCAD.

Canadian trade balance is scheduled to be released today, and it is forecasted to print -2.6B versus previous -2.9B.

Building permits and PMIs have been scheduled for tomorrow, while unemployment claim is lined up on Friday.

BoC’s monetary policy and manufacturing sales are key focuses for next week.

On account of these entire data events put together, we could foresee higher implied volatilities in the days to come.

FX Option Trading Strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

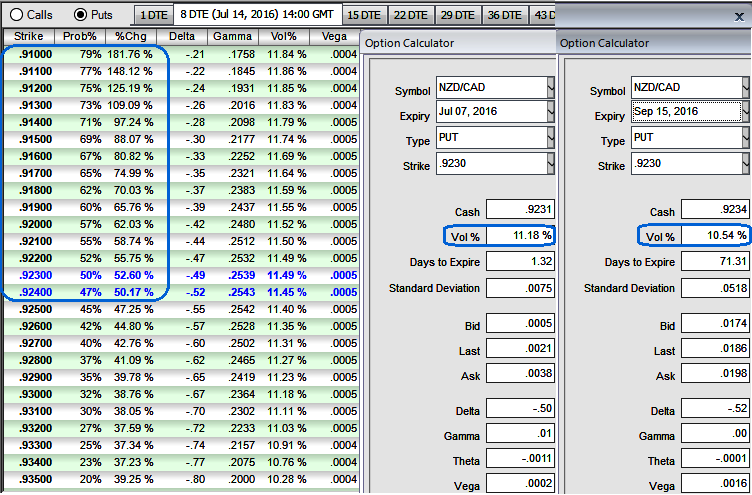

Rationale: Let’s glance on sensitivity tool for put options of this pair, it flashes up higher probabilistic numbers for OTM strikes which would mean that higher likelihood of expiring these contracts in-the-money.

As we have ATM implied volatility of these contracts of 1w tenors are on higher side, thereafter in a long run IVs are stagnantly creeping up above 10.50%, synthesizing all these aspects in a go, the higher IV implies the market reckons the price would more likely move towards these put option strikes, as a result we reckon it is beneficial for OTM call strikes writers.

At current spot at 0.9235, the pair is likely to move towards lower strikes in volatile markets caused by data season as stated above, we would like to position the option trades as shown below so as to match the sensitivity tool indications.

The execution:

Go long in NZDCAD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, Short 1W (1%) out of the money call with positive theta.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts