The recent Canadian developments have reinforced dual perspectives on CAD prospects through 2018 – that the resumption of gradual BoC normalization would drive outperformance vs lagging peers, but that NAFTA remains a lingering risk, at least in early 2018.

No doubt, the oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

But a strong run of data, including that showing evidence of capacity tightening, make likely BoC’s next hike to be delivered next week, and for the central bank to deliver a series of quarterly hikes in 2018. Canada’s economic surprise index is now back to highs last seen last summer, during which BoC signaled, then delivered two back-to-back hikes.

In particular has been the key measures associated with capacity tightness adding confirmation on the need to continue to normalize policy settings. This includes the unemployment rate which fell to 5.7%, below the prior cycle low of 5.8%, in an acceleration in this labor market tightening which delivered a 0.6%-pt decline in two months, the fastest such pace in 20 years.

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

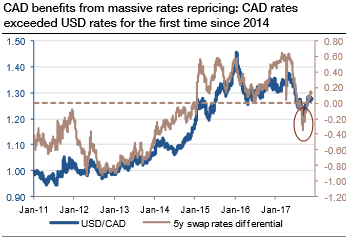

However, the loonie is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. We reiterate that CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph), and USD rates projections can realistically drag the USDCAD to 1.20.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 53 levels (bullish) ahead of BoC’s rate hike hopes, while hourly USD spot index was at -35 (bearish) while articulating (at 12:16 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays