The new Mexican President will be elected on 1st July. At present, the polls predict a clear victory for Andrés Manuel López Obrador. The leftist-populist is certainly not the favourite as far as the financial markets are concerned, nor would his election make the NAFTA negotiations any easier. However, it remains to be seen how his plans will actually be implemented – election campaign rhetoric is often populist, whereas their implementation is often more pragmatic.

That Andrés Manuel López Obrador will win the presidential election should largely be priced into the exchange rate. The big question now is whether the Left Alliance Morena can win the majority in the Senate. Should the president no longer be limited by an opposition-dominated Senate, nervousness over excessive spending by the new government could mount in the financial markets.

In this case, the peso could come under devaluation pressure. At least AMLO's ideas of the important NAFTA negotiations do not differ noticeably from Mexico’s current position.

Whether or not a breakthrough can be achieved in the NAFTA negotiations, however, is not solely in Mexico’s power. All in all, the Mexican central bank (Banxico) has already pre-empted "election risk" affecting the MXN at its meeting last week: with a rate hike of 25 basis points to 7.75%. Should the uncertainty persist, it will further raise policy rates.

After the election, we expect MXN strength to continue as the environment rewards high-carry currencies with reduced uncertainty. We recommend hedging MXN exposures in the short-term but expect renewed foreign interest in 2H’18.

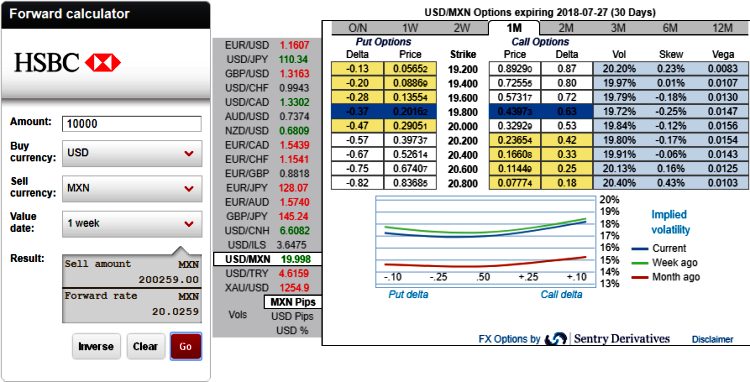

At the current market juncture, USDMXN 1M FVAs mid with the start date set to Q2 end are priced more than 8 vols below the January cycle high and come at a modest 1.3X ATM vols implying a good value in owning election vol to hedge the residual election risk. With overnight pricing commanding a punchy bid/offer, the equivalent pre-/post-calendar spreads (selling pre-event options and buying post-event options in order to isolate and capture sharp spot moves/realized volatility) are worth considering.

Please be noted that the 1m IV skews are stretched on either side that indicates both bullish and bearish risks on the cards. Thus, we recommend buying 12-week USDMXN ATMF straddles @19.75/16.25 financed by selling 8-week straddles. Courtesy: Commerzbank, JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 166 levels (which is bullish) while articulating (at 13:56 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts