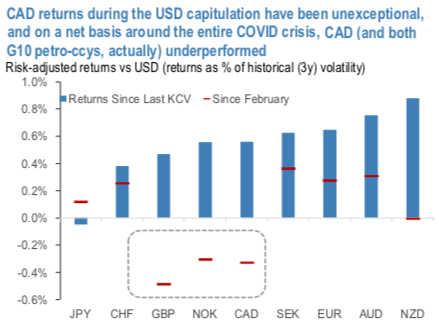

USDCAD has fallen a sizable 4% since our last publication, but this is reflective entirely of the broad dollar’s anti-cyclical properties and negative beta to risk, and is not indicative of outright CAD outperformance. CAD headwinds bias our USDCAD forecasts higher over the medium-term. In some ways, that CAD has only depreciated 2.2% on net against the dollar since March despite the intervening pandemic-led global recession, Saudi-Russo price war, briefly-negative oil prices, and the single greatest Canadian economic & labor market shock ever is remarkable. But this is indicative more of the recent market paradigm shift around risky markets and the USD which has whole-heartedly embraced of the reopening of global economies and the attendant bounce-back in growth, despite the fact that global benchmark oil levels are still 25-30% below pre-crisis levels and US & Canadian unemployment could remain above 10% of the remainder of the year. Indeed, despite USDCAD touching 1.33 and dropping 6.5% total since mid-March, CAD is unexceptional when compared against other G10 currencies this month and, against pre-COVID levels, CAD is actually a relative laggard in G10 (refer above chart).

Thus, despite recent USDCAD weakness, we continue to harbor reservations about the prospects of CAD’s resilience this year, but believe this pessimism is better expressed tactically through crosses than versus the USD as the latter continues to consolidate in the pro-growth environment and as CAD remains well-correlated with riskier assets.

Trading tips: At spot reference: 1.3653 levels (while articulating), one-touch call options strategy is advocated using upper strikes at 1.38 levels. One can see exponential yields as the underlying spot FX keeps spiking towards upper strike on the expiration.

Alternatively, we recommended directional hedges that comprised of longs in USDCAD futures contracts of July’20 delivery, simultaneously, shorts in futures of June’20 delivery. The short leg has delivered desirable hedging objectives so far due to the price dips in the recent past. While long leg of July tenor should be upheld with an objective of arresting potential bullish risks.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential