Canadian data announcements have been lined up for the next weeks, with unemployment data scheduled for today, BoC monetary policy is on 15th followed by press meet, while retails sales and CPI flashes to print on 21st and 22nd respectively.

The market has already lowered its expectations for today’s publication of the Canadian labour market report for March. It expects a loss of half a million jobs and a rise of the unemployment rate by almost 2 percentage points from 5.6% to 7.5%. The US labour market report last Friday gave a first taste of how pronounced the economic collapse in North America has been.

However, similar to the situation in the US the March report in Canada only reflects the data until mid-March.

However, the claims for employment insurance recorded a particularly steep rise from that point onwards: the Canadian government has received 3.18 million requests for income support since 16th March, 2.5 million of which for employment insurance and 642,000 as part of the government’s emergency programme (Canada Emergency Response Benefit, CERB). Even though the government under Justin Trudeau initiated a CAD 71bn. programme as an incentive for companies to keep their employees on the payrolls, according to a poll by the Canadian Federation of Independent Business more than 60% of companies expect lower levels of full time employment over the coming months.

In other words: first of all the market expectations for today’s labour market report might turn out to be too cautious which would put pressure on CAD. Combined with a continued weak oil price that is not a good starting point for the loonie so that USDCAD is likely to remain above 1.3950. However, the real smacker is going to be the labour market report in May as this will then contain the disastrous data from mid-March to mid-April.

OTC Outlook And Options Strategy:

Given these concerns, it makes sense that CAD has decoupled from oil from the recent weeks as the focus on Canada's specific weaknesses grows larger. Despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair.

Hence, add longs in USDCAD via options contemplating above fundamental factors and below OTC indications:

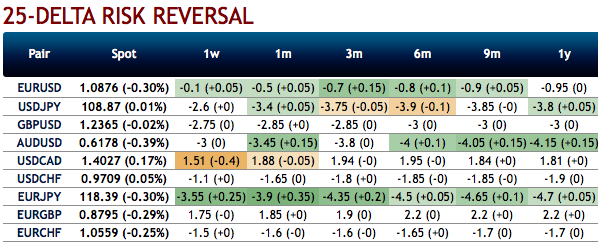

The fresh negative bids are observed to the existing bullish risk reversal setup that indicates the mild price dips amid the broader hedging sentiments for the upside price risks (refer 1st chart).

While the positively skewed IVs of 3m tenors are indicating the upside (refer 2nd chart), bids for deep OTM call strikes up to 1.45 levels is interpreted as the hedgers are inclined for the upside risks.

Hence, at this juncture (when spot reference: 1.4028 levels), we upheld our shorts in CAD on hedging grounds via 3-month (1.3815/1.45) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & Commerzbank

Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts